9.12 Questions

Question 1:

The residual income approach to

valuation and the abnormal earnings approach to valuation differ

in terms of their relative emphasis upon the balance sheet and

income statements.

Which technique places more emphasis on the income statement?

Provide support for your answer.

Question 2:

Residual

income and Normal Earnings exploit the economic concept of an

“opportunity cost.”

Describe how each concept exploits the concept of an opportunity

cost including how they differ in how they measure opportunity

costs.

Question 3:

Describe in words what Normal

Earnings is.

Question 4:

What is Cum-Dividend Earnings?

Question 5:

Explain how the economic

concept of opportunity costs is applied to the concept of

Cum-Dividend Earnings.

Question 6:

Define abnormal earnings growth

and describe its meaning in your own words.

Question 7:

Explain precisely how the

economic concept of opportunity costs is applied to the concept

of abnormal earnings growth.

Question 8:

What is the relationship

between abnormal earnings growth and the concept of residual

earnings?

Question 9:

Suppose you are assessing the

intrinsic value of a firm that pays zero accounting dividends.

Can you apply the abnormal earnings growth model to this

firm? Provide

reasons in support of your answer.

Question 10:

When computing the intrinsic

value of a stock using the abnormal earnings growth model an

analyst identifies the earnings to be capitalized in perpetuity

and divides by the discount rate (i.e., the cost of equity

capital). What are

the three components that make up the earnings to be capitalized

in this model?

Question 11:

Describe in words what is the

Present Value of Abnormal Earnings Growth at time t.

Question 12:

Describe in words what the

Present Value of Continuing Value at time t is.

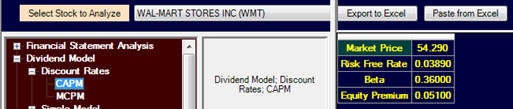

Data for next few questions

For Wal-Mart, assume the following inputs

for CAPM:

The following additional information

contains the Consolidated Statement of Shareholder’s Equity and

Consolidated Income Statement for Wal-Mart from their 2010 10-K

filed with the SEC:

Excerpt from the Consolidated Statement

of Financial Position (Year ending Jan 31, 2010, Jan 31, 2009

respectively)

Additional Information: Total Walmart shareholders’ equity for year end Jan 31, 2008 = $64,608

Additional Information:

Total Dividends Paid

Year ending Jan 31, 2010

$4271, Year Ending

Jan 31, 2009

$3746, Year Ending

Jan 31, 2008 $3586

Non-controlling interest:

Year

ending Jan 31, 2010 2180, Jan 31, 2009 1794 and Jan 31, 2008 not

reported

Question 13:

By referring to the

information available for this question calculate Comprehensive

Income and Comprehensive Income per share for the purposes of

valuing Wal-Mart for 2009.

Provide brief reasons in support of your answer.

Question 14:

Calculate the Dividend Payout

Ratio relative to Comprehensive Earnings for year ending January

2010. (Assume that

outstanding common stock is the ending balance of share for Jan

2010 provided).

Question 15:

Assuming CAPM and the data

provided calculate Wal-Mart’s Normal Earnings for 2010.

Question 16:

Assuming CAPM and

the data provided calculate the Cum-Dividend Earnings for

Wal-Mart for 2009.

Question 17:

Assuming CAPM and the data

provided calculate the 2009 Abnormal Earnings Growth for

Wal-Mart.

Question 18:

Assume the CAPM data provided

remains constant over time, calculate the difference between

Residual Income for 2009 and 2008.

Question 19:

In the light of your answers to

the two previous questions are they consistent with what the

predicted relationship is between Abnormal Earnings Growth for

2009 and the difference between Residual Income for 2009 and

Residual Income for 2008.

Question 20:

Compute the ROCE

(Return on Common Equity) for the year ending Jan 31, 2010 using

Comprehensive Income for Wal-Mart.

Real World Exercise: Assessing

Intrinsic Value Using the Abnormal Earnings Growth Model

Approach to Estimating Intrinsic Value

Select two companies from the Current FTS

Dataset that are competitors, or at least are in the same

industry even if they do not directly compete with each other.

Prepare an analysis of each stock’s

intrinsic value by applying the Abnormal Earnings Growth Model

of Intrinsic Value. You

should identify the major inputs you need from the Valuation

Tutor’s Calculator.

This model requires estimating the growth

rates for projecting Comprehensive Income 1 year ahead, 2-year

ahead and for the next n-years depending on how many years you

define stage 1 to be and then finally the normal growth rate.

In addition, you need to assess the discount rates (i.e.,

cost of equity capital inputs).

It is recommended that you first refer to the real world

projects at the end of chapter 4 when completing these parts.

Identify the major inputs required to

assess the intrinsic value using the Abnormal Earnings Growth

approach including the important assumptions you have made to

come up with this assessment.

You should discuss issues that arose when implementing

this model. That

is, what are the critical variables that underlie your analysis

and how reliable do you assess your estimates for these

variables to be when valuing your two stocks.

What is the intrinsic value for your two

stocks and what is your forecast of Expected Return (Implied

Expected Return in the calculator).

These are the calculated values from the Valuation Tutor

calculator. In

addition, the support working for how these numbers were arrived

at is provided in a support window.

You are encouraged to refer to the text to understand

where these numbers have come from.

Bottom Line Requirements:

1.

What is

your bottom line analyst recommendation for your two stocks?

This should be a recommendation that can range from

Strong Buy, Moderate Buy, Hold, Moderate Sell, and Strong Sell.

2.

What is

you forecast for the future stock price in 1-year’s time?

Hint: Apply

the Expected Return calculated in Valuation Tutor and multiply

by the spot stock price such that the forecast price equals P *

(1+E(Return)^1-Year