9.1 Abnormal Earnings Growth Model

In

Chapter 3, we introduced one of the most popular accounting

ratios, the ROE (Return on Equity), and showed you how this

ratio is related to growth (and is sometimes called “fundamental

growth).

In the last chapter, you studied the RIV model, where the

focus is on the book value of equity; in fact, we motivated the

model in this way.

Most analysts, however, focus on earnings.

The P/E ratio is used as a valuation tool (the value

equals expected earnings times the multiple).

The relationship between earnings and intrinsic value is

the subject of much research, and some references include

Williams (1938), Modiagliani and Miller (1958), Ohlson (1995)

and Ohlson and

Juettner-Nauroth (2005).

The more recent works study the relationship between

earnings and value under names like the Abnormal Earnings Growth

model (AEG) and the “OJ” model.

In some ways, we have come full circle; we started with a

cash-based model (the dividend model) and extended it to the

free-cash flow model.

Then we moved to the RIV model and shifted the focus to

the book value; we now return to earnings, which lie at the

heart of cash flows and growth in shareholder equity.

The Abnormal Earnings Growth model carries along with it the

clean surplus relationship and comprehensive earnings.

Under clean surplus, there is an implied equivalence

relationship between AEG and the change in Residual Income,

which this chapter demonstrates.

So you may ask: what is the contribution of AEG over and

above the Residual Income model?

If they are analytically equivalent, then why not just

apply the Residual Income model?

One answer to this question is that implementations of

the two models can lead to multiple estimates of intrinsic

value because real world imperfections imply that clean surplus

will not literally hold.

A second is that the AEG model provides different

insights into what drives firm value by focusing on earnings

rather than book value.

The growth behavior of a firm in practice is complex and

difficult to estimate.

In Chapter 1, we introduced the business model and

business strategy, and you saw that growth behavior in the real

world is both dynamic and complex.

In Chapter 3 we introduced the concepts of fundamental

growth and the degree of leverage, the latter under a simple

(fixed versus variable) cost behavior assumption.

These concepts provide methods for estimating growth

directly from firm fundamentals.

In Chapter 3 and later, you saw that analysts provide

discrete forecasts of growth behavior that you can access easily

within Valuation Tutor.

These forecasts are for a specific set of times ahead,

1-quarter, 2-quarters, and 1-year, 2-year and 5-year forecasts.

However, imperfections in the market, such as

information, measurement and aggregation imperfections, result

in different approaches (analyst versus fundamentals) often

providing very different growth estimates.

In fact, most growth estimates rely upon simplifying

assumptions. For

these reasons the clean surplus relationships are unlikely to

literally hold in the real world in the presence of dynamic and

complex growth behavior, and the implementation of the two major

accounting valuation models in practice will lead to different

assessments of intrinsic value.

When resolving these issues, equity analysts use their judgment

combined with their knowledge of the business model, business

strategy and how these affect financial statements.

For example, RIV often applies to firms whose business

model requires significant assets on their books, such as a

steel producer, while AEG best applies to business models that

are best described from earnings, such as a talented human

capital oriented firm.

Recall that shareholder equity is assets minus

liabilities. If a

firm has mostly physical capital in its assets, ROE can be low.

On the other hand, a firm that generates the same

earnings but has mostly human capital will have a very high ROE.

This is an imperfection in how assets are measured, and

this makes a difference, as we now demonstrate.

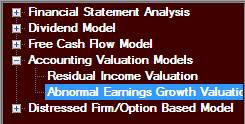

Consider IBM. Item

1A of their 10-K clearly identifies their strategic shift over

the last decade:

STRATEGY

Despite the volatility of the information technology

(IT) industry over the past decade, IBM has consistently

delivered superior performance, with a steady track record

of sustained earnings per share growth. The company has

shifted its business mix, exiting commoditized segments

while increasing its presence in higher-value areas such as

services, software and integrated solutions. As part of this

shift, the company has acquired over 100 companies this past

decade, complementing and scaling its portfolio of products

and offerings.

Since they have exited commoditized segments to areas requiring

less physical capital, earnings are more informative than the

book value of assets in understanding IBM’s statements.

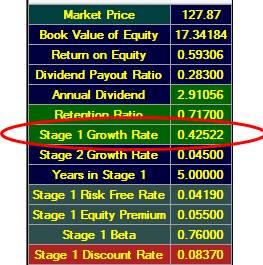

This comes up quite clearly when you compare estimates of

fundamental growth for IBM based upon ROE versus current analyst

forecasts. To see

this first select Fundamental Growth 2 Stage in the ROE form of

the dividend model:

The Valuation Tutor calculator immediately flags the issue:

Fundamental growth when measured relative to the book value of

shareholder’s equity (42.5%) is much higher than current five

year analyst forecasts for IBM’s growth; the latter range

between 10% and -11%.

This is to be expected given that IBM’s business model

more heavily relies upon its human talent pool (which is not

measured in a traditional balance sheet) compared to real assets

that are measured by traditional accounting systems.

On the other hand, earnings reflects the

results from its human

talent pool.

This shift in business strategy also implies that IBM’s

sensitivity to the business cycle has increased which analysts

must consider when assessing the cost of equity capital.

The specific

learning objectives for this chapter are to understand:

·

What are Normal Earnings?

·

What are

Cumulative-Dividend Earnings?

·

What is Abnormal Earnings

Growth?

·

How do we estimate

Abnormal Earnings Growth?

·

What are the major inputs

into the Abnormal Earnings Growth Model?

·

How do we apply the

Abnormal Earnings Growth Model Using Valuation Tutor?

·

How to perform sensitivity

analysis on the key drivers to test their reasonableness?

·

What is the expected

return from a stock using the AEG model?

In the first

section we will first develop the new concepts introduced before

applying the AEG Model.

We start by defining what is meant by Normal Earnings and

then relate this concept to the idea of Abnormal Earnings

Growth.

As in the

residual income model, the accounting concept of income is

extended to account for opportunity costs.

In the last chapter we focused upon the balance sheet to

calculate opportunity costs in terms of the cost of equity

capital times the book value of shareholders’ equity net of

dividends paid to shareholders.

In this chapter we focus on the income statement and

calculate opportunity costs directly with respect to

comprehensive income (cum-dividends) and then adjust for the

opportunity costs associated with dividends paid to shareholders

Under clean surplus accounting and in a perfect market

world these two approaches are equivalent.

However, in a world with market imperfections arising

from aggregation issues, incomplete information and problems

associated with forecasting dynamic growth behavior these two

approaches will differ when implemented. As a result, judgment

must be used when choosing which valuation technique to apply

and this will depend upon assessing which statement is more

affected by these market imperfections as suggested by the IBM

example provided in the introduction.