10.7 Questions

Question 1:

Can a firm with a

negative shareholder’s equity trade with a positive price?

Discuss.

Question 2:

Define what is meant by the term “going concern.”

Question 3:

Define

what is meant by the term “distressed firm.”

Question 4:

When public companies file 10-K reports to the SEC.

Who is responsible for issuing a “going concern” opinion?

Question 5:

What does the Altman “Z-Score” attempt to measure?

Question 6:

What do major rating agencies such as Moody’s, Standard and

Poor’s and Fitch provide ratings of?

Question 7:

Describe the difference between the rating system for a major

rating agency and an auditor’s opinion.

Question 8:

What is meant by the term “Investment Grade” and why do

public companies try not to fall below what is referred to as

“Investment Grade.”

Question 9:

Define what a call option is and describe the difference

between a put option and a call option.

Question 10:

Define what an option payoff diagram is and draw an option

payoff diagram for a call option and a put option.

Question 11:

What is the fundamental accounting equation and provide a

description of its component terms.

Question 12:

In Merton’s model for valuing a distressed stock the stock is

viewed as an option.

Describe precisely what type of option and what the underlying

reasoning in support of this is.

Question 13:

If you are applying Merton’s model to value a distressed firm

what are the inputs required and provide a description of each

input.

Question 14:

Define the term “asset volatility” and describe the

difference between the terms “asset volatility” and “stock return

volatility.”

Question 15:

Would you expect that asset volatility is higher, the same or

lower than stock return volatility?

Provide supporting reasons for your answer.

Question 16:

What is the major difference between the Merton Model and the

Extended Merton Model for a distressed firm?

Question 17:

In chapter 4 you were introduced to the concept of cost of

equity capital and two approaches to estimating the cost of equity

capital (CAPM versus MCPM).

Suppose you are valuing a distressed stock that has a low

beta under CAPM. Which

method for estimating the cost of equity capital do you think would

provide the better estimate for cost of equity capital?

Provide reasons in support of your answer.

Question 18:

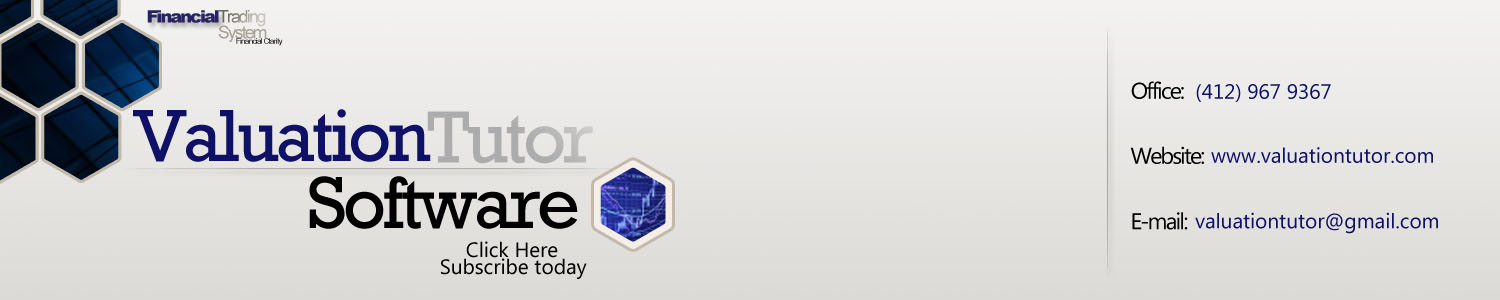

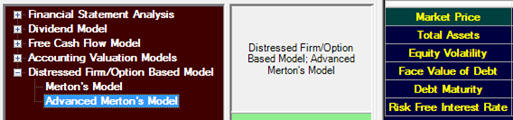

Valuation Tutor provides two methods for assessing the value

of a distressed firm as depicted in the screens below:

Describe what

each of these inputs are and be careful to describe any important

differences in inputs.

Question 19:

When using the Valuation Tutor’s calculator for assessing the

value of a distressed firm you get a number referred to as “implied

volatility” if it exists.

Describe precisely what this number is for i. the Merton

Model and ii. The extended Merton Model?

Question 20:

When assessing the intrinsic value for a distressed stock

using Merton’s model, do you need to first estimate the expected

return from the underlying asset?

Provide reasons in support of your answer.

Question 21:

Does Merton’s model apply to stocks that are going concerns?

Provide reasons in support of your answer.

Real World Exercises: Assessing

Intrinsic Value of a Distressed Firm

Select a stock

that you judge to fall within the category of a distressed stock.

You can use Valuation Tutor to help you with this initial

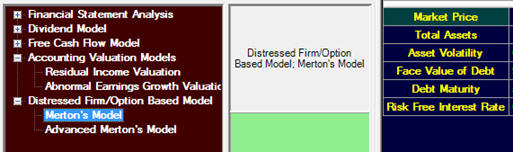

selection by doing the following.

Step 1:

Read in the default data set by selecting “Download Current

FTS Dataset”) and then in the Business Ratio section of the tree

select the Altman Model as follows:

Above the

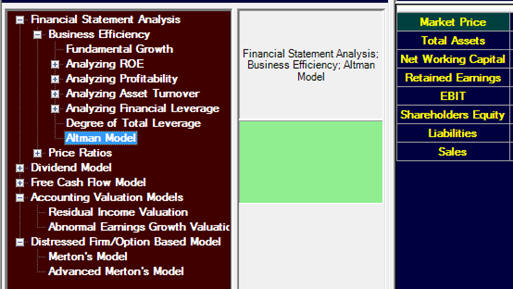

calculator click on the button that says Calculate for All.

This will compute Altman bankruptcy scores for all stocks in

the FTS Dataset.

In the pop up

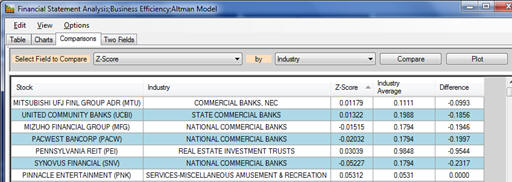

window click on Compare Z-Score by Industry and then Compare:

Then double

click on Z-Score to sort the Z-Score from lowest to highest:

You can then

browse through the stocks with low Z-Scores to select one that you

would judge to be distressed.

Once you select the stock browse through its 10-K to

reinforce your initial assessment that it looks like a distressed

stock. For example,

check to see whether they have a negative shareholder’s equity plus

a low Z-score for example.

Check and record

the current stock price in the market.

The general

question you would like to address here is why does a stock with a

negative shareholder’s equity trade with a positive price?

The answer to

this is that it is trading with an option value which is what you

will estimate by applying Merton’s distressed firm model.

Next estimates

the inputs required for the Advanced Merton Model.

Tip:

You may want to estimate the annualized volatility from daily

stock price returns in Excel by first downloading the previous

year’s daily prices from either Yahoo Finance or MSN Money.

Once you have

Identify the major inputs required to assess the distressed stock

value using the advanced Merton’s model.

Compare this estimate with the current spot stock price and

provide a bottom line analyst recommendation for distressed stock

investors.

This can range

from Strong Buy, Moderate Buy, Hold, Moderate Sell, and Strong Sell.

Of course, this

recommendation is only targeted at investors who are willing to

assume large amounts of risk and is not meant to be aimed at a

traditional investor.