10.6 The Extended Merton Model

In the extended

Merton model, the asset volatility is replaced as an input by the

equity volatility. The

relationship between the two volatilities is:

Given the

equity volatility, we can try and solve this equation for the asset

volatility. Note,

however, that a solution does not always exist; if it does

not, then Valuation Tutor responds with “N/A” in its calculated

fields.

The standard

Merton Model above already tells you the equity volatility needed to

match the asset volatility; is 3.48221 in the example we just

completed. But that is

not the point; we want the equity volatility to be the input and see

what the resulting asset volatility and stock price are.

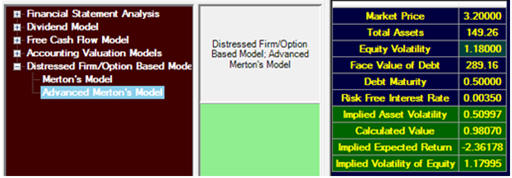

We calculated

the historical volatility of GM in 2008 using daily data for the

year; the equity volatility was 118%.

Entering this into the advanced Merton model yields:

This has an

implied asset volatility of about 51%, which is much lower than the

65% needed to match the stock price.

But this is to be expected; we have assumed that the entire

debt of GM is due to be paid within 6 months.

A more detailed analysis would look at the structure of the

liabilities and determine what the appropriate time period is.

For example, if we assume the debt is to be paid off in four

years, the values match the prices of GM quite closely: