10.5 Example 2:

General Motors (GM)

At

the time of the writing of this chapter, GM is not longer under the

ticker GM, instead it is trading as “Motors Liquidation Ordinary

Shares” and ticker MTLQQ. On Dec 31

2008, it traded at $3.20 per share.

To get

information about GM, in the information system, click “View Another

Ticker:”

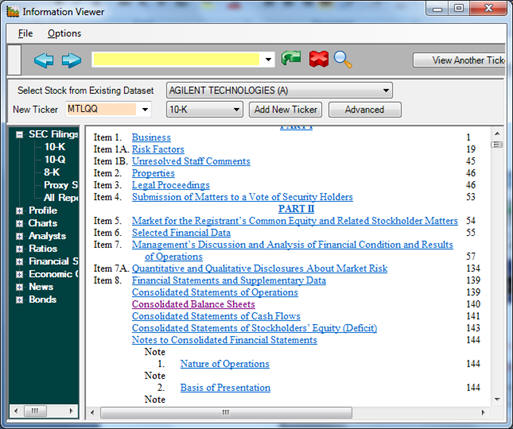

In the new window that appears, type in MTLQQ as the ticker, select filing tyoe 10-K, and add the ticker. GM’s 10-K will appear:

The “Interactive

Data” link is not available, so click on the 10-K document, scroll

down to the table of contents and click on “Consolidated Balance

Sheets”:

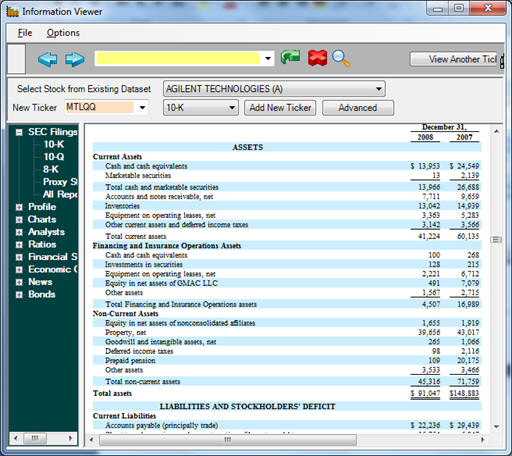

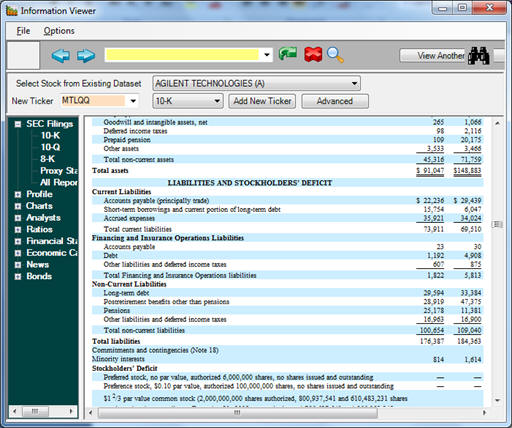

This leads you

to the statement of assets and liabilities, and when we did this,

the assets at the end of 2008 were 91.047m:

Scroll down

further to see the liabilities at the end of 2008:

You can see the

breakdown of liabilities, the total being 176.387m.

The shares

outstanding were 610 (all the amounts are in millions).

So we have the assets and the strike price of the option on a

per-share basis: A = 149.26, F=285.16.

What should we

use as the maturity of the option?

Technically, this is the first date at which a company fails

to make a debt payment; that failure triggers default, and under the

laws of many countries, the bond holders are then among the first in

line to either receive the assets of the company or, as commonly

happens, to agree to a restructuring.

But at that point, the stock is worthless. Let us calculate

what the value of GM would be if all the debt was due in 6 months.

The 6 month

Treasury bill yield at the time was 0.34%.

So that leaves

the last input, asset volatility.

To start with, let’s try different volatility numbers and see

how much difference they make.

We did the exercise repeatedly in Valuation Tutor to come up

with the following:

|

Asset Volatility |

Calculated Value |

Market Price |

|

0.4 |

0.1941 |

3.20 |

|

0.5 |

0.8761 |

3.20 |

|

0.6 |

2.2380 |

3.20 |

|

0.6512 |

3.2000 |

3.20 |

|

0.7 |

4.2700 |

3.20 |

You can see that

with an asset volatility of 0.6512, the calculated value matches the

market price:

So it is

plausible that the stock could trade for $3.20.

Of course, we had to guess at the asset volatility to make it

come out right, i.e. ask: what asset volatility makes the calculated

value equal to the market price?

So you might be asking how useful this is.

It turns out you

don’t have to guess. You

can calculate the asset volatility in another way, from the

volatility of the stock return.

This volatility can be calculated from historical stock

returns or as the implied volatility from options on the stock.