4.2

The Economics of Retrading

|

W |

hat is interesting about the two-period binomial

model is that it allows determination of the option price by forming a riskless

hedged portfolio from two securities, even though we have more than two terminal

stock prices (Suu, Sud, Sdu, Sdd) and

therefore more than two distinct call option values.

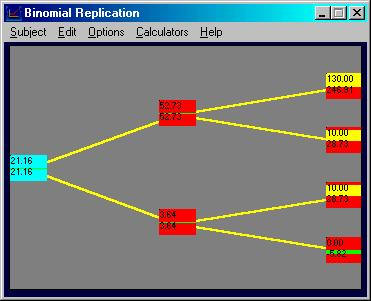

Figure

4.1

Binomial

Tree for Stock Prices

In Figure 4.1, the underlying asset value is

path-dependent whenever Sud is not equal to Sdu.

Although the same principles apply to path-dependent and path-independent

options, it is simpler to value path-independent options.

We therefore focus on them in this section.

If we assume that ud = 1, in

which case Sud = Sdu = S, then

multiple paths lead to the middle terminal node.

Figure

4.2

Binomial

Tree: Path Independent

Then, after two periods, a call option with Sd

< S < X < Su has payoffs:

Suu -

X, S - X, and 0.

Now suppose you want to

form a synthetic call option from a portfolio of n stocks and m bonds.

How would you do this? Observe

that there are three possible end-of-period values to be replicated, but only

two securities to work with. The

equations you have to solve are:

nSuu

+ m Br = Suu - X

nS +

m Br = S - X

nSdd

+ m Br = 0

We have three equations and only two unknowns.

You know that one way of solving this is to create a portfolio of three

securities but you also know that you can solve for the call price from a

replicating portfolio of only two securities (the stock and the bond).

What is going on?

The answer lies in the ability to

rebalance your position. You do

not have to hold your portfolio for two periods, but instead can re-trade at the

end of the period.

You may have observed in the two-period

problem for a European call option, in Chapter 3, that the hedge ratio at

each node is different. In

particular, the three hedge ratios are:

Thus, if you create

the riskless hedge portfolio at the beginning of the first period, you would

have to adjust your position at the beginning of the second period to ensure

that you have the appropriate hedge ratio.

You can apply this important principle by working

with two of Option Tutor's interactive

subjects, Binomial Replication and Binomial

Delta Hedging. The software

allows you to choose at each node the trade that should be executed either to

maintain a riskless portfolio or to create a synthetic option.

You will see that the number of stocks required to maintain a riskless

position changes at each node. You

can solve for such a position using the Binomial

Delta subject in Option Tutor.

For now, let us work backward through the tree to

try and create a synthetic option.

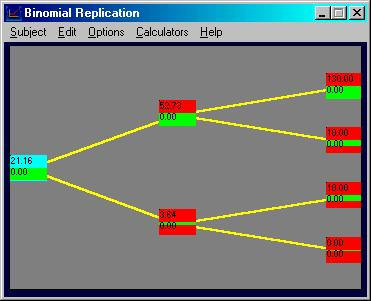

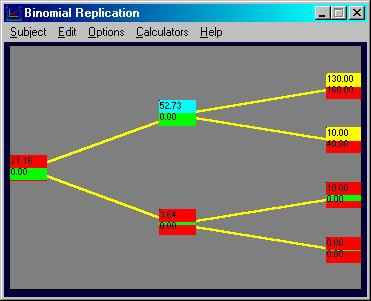

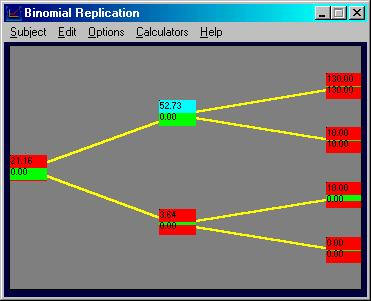

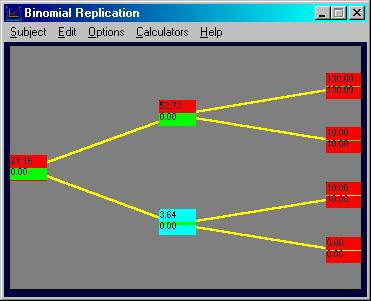

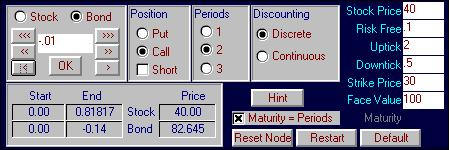

Online click on the Subject menu item and choose

Binomial Replication. Change the

default values to stock price = $40, uptick = 2, riskfree = 0.10 (discrete

compounding), strike price = 30. Similarly

select to display the call option with a two-period life. Your screen should appear as follows:

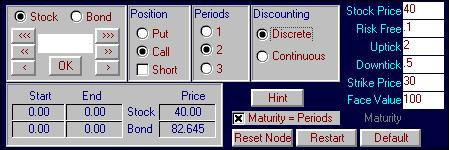

Click on the uptick node (currently labeled 52.73

and 0.00). By choosing to go long 1

stock observe that the difference between the call option payoff, and the

portfolio that has bought 1 stock (at $40), is $30.

You can see this as follows:

As a result, by introducing some riskfree bonds

result in a synthetic call option being created.

In particular consider shorting (i.e., borrowing) 0.3 riskfree bonds with

a terminal face value equal to $100. This

reduces the terminal node payoffs by $30 which results in a synthetic call

option being constructed at the first uptick node.

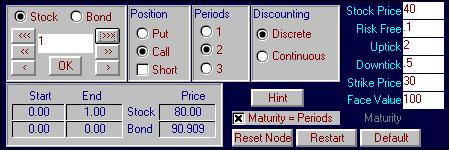

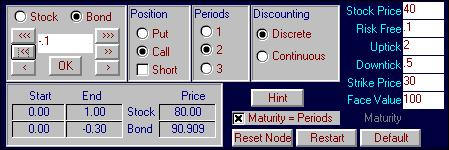

Similarly we can construct a synthetic call option

if we find that a downtick is realized resulting arriving at the node labeled

3.64. Here the stock and bond

position is 0.3333 stocks and -0.0333 bonds.

Note: to control the 0.01

digit you can click on the button with a single >. However, to control the 0.001 and 0.0001 digits to get to

four decimal place accuracy, you need to type into the box 0.001 and click OK

several times, and similarly for 0.0001. If

you want to subtract type in –0.0001 and click OK repeatedly.

After a little trial and error you will quickly control finer decimal

places.

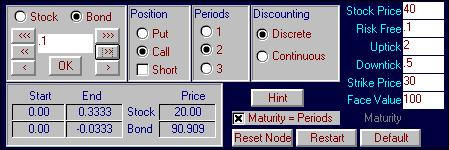

Finally, at the beginning node we can construct the

synthetic call option by first clicking on this node and then by acquiring

0.81817 stocks (using the same trick as described above to control higher

decimal places by typing in 0.00001 and clicking OK 7 times to add 0.00007) and

selling 0.14 bonds as follows:

That is, at every possible node that you can reach

there exists a position that can be constructed from stocks and bonds using

the prevailing market prices that exactly mimics the call option.

This argument is presented for the general case as

follows:

Consider the two nodes depicted as black dots in

Figure 4.3.

Figure

4.3

Binomial

Tree for Stock Values

To find the appropriate number of stocks and bonds

to create a synthetic option, let n be

the number of shares and m be the

number of risk-free bonds.

Then nu , nd , mu , md

are

node-specific and must solve:

nu Suu + mu

Br

= Suu - X

nu S + mu

Br

= S - X

nd S + md

Br

= S - X

nd Sdd + md

Br

= 0.

We now have four equations and four unknowns.

From this set of equations, you can determine the synthetic form of Cu

and Cd, as we did before.

Finally, step back to time 0, the first node.

Now there is only one node left (depicted by the black dot in Figure

4.4).

Figure

4.4

Initial

Node Reached

Again, we need to find n

and m to solve

where Cu

and Cd are as obtained above.

Once you solve these equations for n

and m, you will know the price of the

call option.

The important principle here is that the ability to

trade at each node has the same effect as increasing the number of

markets that are open.

Formally, trading increases the set of possible

payoffs that we can achieve without having to open up additional markets.

Therefore, there is an interesting trade-off when hedging some risk.

The trade-off is between creating more complex portfolios as opposed to

more frequent retrading of a smaller number of securities.

Rebalancing is the essence of Delta Hedging, our next topic.

office (412)

9679367

office (412)

9679367