3.8 Liquidity

Ratios

Liquidity ratios can be

traced back to emergence of ratio analysis when banks started to

demand financial statements in the latter 19th

century. These

ratios are designed to provide an indicator of a firm’s ability

to repay its debts over the next twelve months.

As a result, they are computed from the current assets

and liabilities section of the balance sheet.

Recall, the previous topic introduced working capital

ratios. These ratios

let a user assess how efficiently a firm is transforming its

inventory into sales and how the firm is managing to collect its

receivables and pay its payables.

Liquidity ratios complement this working capital analysis

by extending this to the analysis to assess whether a firm can

meet its short run or current obligations.

A further distinction can

be made in the subsequent topic, between

liquidity and solvency.

Liquidity adopts a short run focus whereas solvency

adopts a longer term focus.

Solvency ratios assess whether a company is likely to be

able to repay their debts in the longer run and thus whether

they are a going concern.

In the next section on financial leverage we introduce

debt ratios that are relevant to assessing solvency.

The primary liquidity

ratios are the Current Ratio and its major liquidity refinements

the Quick and the Cash Ratios.

The Quick and Cash Ratios focus upon a firm’s ability to

immediately repay its obligations.

These are defined as follows:

Current Ratio =

Current Assets/Current Liabilities

Quick Ratio = (Cash

+ Marketable Securities + Accounts Receivable)/Current

Liabilities

Cash Ratio = (Cash

+ Marketable Securities)/Current Liabilities

A major property of the Quick Ratio is that Inventory is

excluded from Current Assets because this requires effort to

convert into cash plus it may only be quickly convertible at a

significant discount.

Similarly, for Accounts Receivable but the discount is

usually much smaller especially since the emergence of

securitization.

Securitization is the process of combining different company’s

accounts receivable and issuing securities against their cash

flows that are sold to investors.

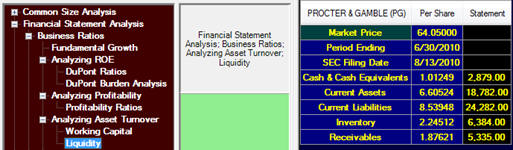

Tutor Reconciliation:

Proctor and Gamble (PG)

Our objective is to reconcile the following from the 10-K:

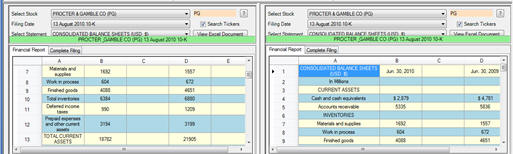

Step 1:

Bring up the Balance Sheet for Proctor and Gamble as

described in section 3.2.

For this example we will bring up two Balance Sheets

instead of both the Balance Sheet and Income Statement.

This is displayed at the bottom of the screen as follows:

For Proctor and Gamble you can see the “Total Current Assets”

($18,782) as P&G describe it and Accounts Receivable are $5,335.

Similarly, total Inventories $6,384 and scrolling down reveals

the working capital items on the Balance Sheet.

Step 2:

Click on Calculate and we can verify the input and

derived fields for the following:

Current Ratio = 0.7735

Quick Ratio = 0.3383

Cash Ratio = 0.1186

In step 1 we extracted the relevant aggregate numbers from the

10-K and so the full reconciliation can now be traced through as

follows.