Chapter 1: Introduction

Valuation Tutor

provides the visual and analytical tools to analyze the

financial statements and reports filed by publicly listed companies

in the US. The system is divided into three parts:

SEC Filings: Visual

Analysis of SEC Filings

Financial Ratios:

Visual Analytics

Intrinsic Value Models

Emphasis is placed upon working with current information,

relevant to today’s decisions, so that learning becomes fun

and useful. Ultimately

this motivates acquiring a deeper understanding valuation

which is important to both preparers and consumers of

financial reports. Valuation Tutor is designed to

reinforce this sequential approach to learning.

The next topic will develop this assertion further, however,

working with real world filings ensures that you acquire the

same

skills used by today’s management, financial analysts and preparers

of the corporate reports.

The

U.S. Bureau of Labor Statistics in their Occupational Outlook

Handbook (2010-11), forecasts that these skills are in strong

demand.

Valuation Tutor starts with the corporate filings (10-K, 20-F and

10-Q), including supporting sub statements, and focuses upon

extracting summary information from these filings to analyze a company and

its immediate competitors.

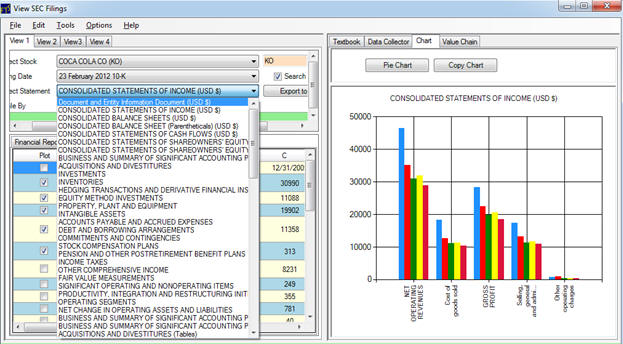

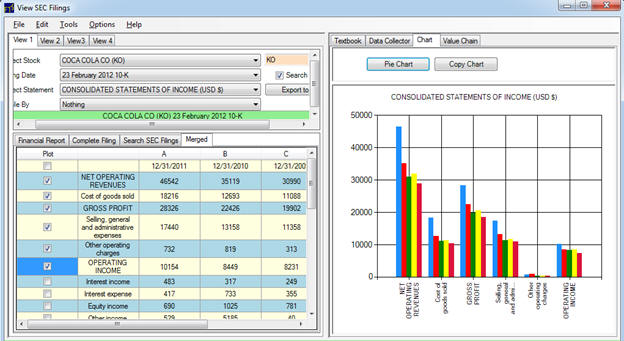

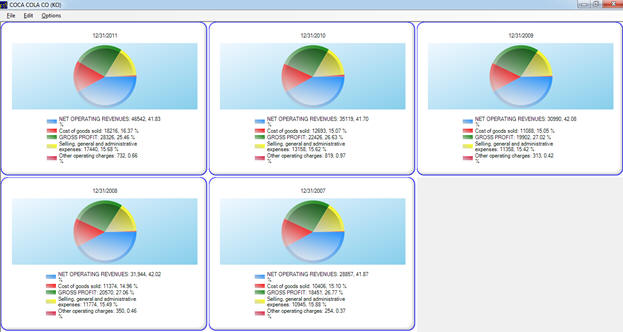

For example, consider the screen below:

This provides a view of trends for Coca-Cola with respect to

their reported Gross Profit and Operating Income over time.

Pie chart analytics then permit the immediate depiction of

the same data to better understand the relative trends.

There are many details in a modern corporate report, and the

screen below depicts a small sample of these support statements in

Coca-Cola’s 10-K: