8.8 Application: Amazon.Com

Summary:

RIV Approach to Estimating Intrinsic Value

Intrinsic

value = Book value per share + Present value of Residual

Earnings discounted back at the stock’s cost of equity capital

(i.e., investors’ required rate of return from investing in

stocks).

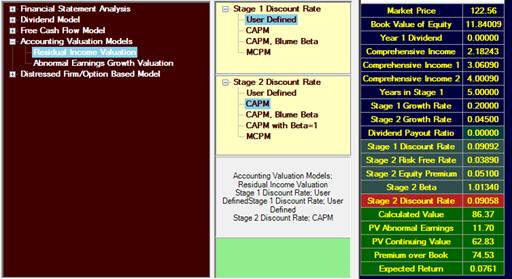

We can now apply this model using the

Valuation Tutor software.

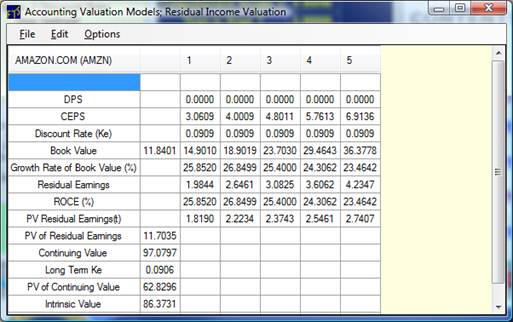

The next figure shows you a calculation for Amazon.Com in

Valuation Tutor.

You can see all the inputs required for the calculation:

It is important to understand where these

numbers come from including what the projected financials look

like over time. This lets you check how realistic

important assumptions such as growth behavior are in terms of

the implied future financial outcomes. When you click

Calculate, Valuation Tutor also provides you with the details of

the calculation: