1.4 Understanding the Firm and Financial

Statement Analysis

Financial statement analysis is a set of techniques to analyze

the financial performance of a company, to assess its strengths

and weaknesses, and to compare it to other firms in the same

industry. It

provides information about the past and current performance of a

company. It is also

used to project the future performance of a company.

It is used by the company’s managers to improve

performance, by analysts who provide recommendations on the

company’s stock, by the company’s creditors who decide whether

to lend money to the company, and by the shareholders of the

company who are interested in the current performance of the

company and in whether the company will continue to be

profitable. A

necessary condition for successful financial statement analysis

by an financial analyst is to first understand the business.

In the “Conceptual and Practical Skills” topic below we

illustrate step-by-step what is really required to understand

the business. Item 1

in the 10-K is an invaluable source of information for this

purpose. This is

because in this item the firm gets to describe their business

model and strategy.

In this section we work through the operational steps required

for unlocking this information from a 10-K.

In turn this information provides a framework for

interpreting the results from a financial statement analysis.

Financial statement analysis uses the uses the financial reports

of a company as its main input.

The Financial Accounting Standards Board (FASB) describes

the objective of financial reporting as follows:

“…… to provide financial information about the reporting entity

that is useful to present and potential equity investors,

lenders, and other creditors in making decisions in their

capacity as capital providers.

Capital providers are the primary users of financial

reporting. To

accomplish the objective, financial reports should communicate

information about an entity’s economic resources, claims to

those resources, and the transactions and other events and

circumstances that change them. The degree to which that

financial information is useful will depend on its qualitative

characteristics.”

The International Accounting Standards Board (IASB) adopts a

similar, but slightly different, approach:

“…to provide financial information about the reporting entity

that is useful in making decisions about providing resources to

the entity and in assessing whether the management and the

governing board of that entity have made efficient and effective

use of the resources provided. The reporting entity concept is

intended to further this objective.”

Conceptual and Practical Skills

Valuation Tutor works directly with company filings. This

includes gaining an understanding the language, the aggregations

and the classifications actually used by public firms when

presenting their accounts.

For example, Valuation Tutor lets you quickly compare the

current major annual and/or quarterly financial statements filed

by some subset of companies that you specify from the SEC’s

interactive data.

In terms of developing your conceptual skills in relation to

these filings we take the perspective of investors, and so our

focus in on understanding how publicly traded companies create

value for shareholders.

An essential tool in understanding how a company creates

value is financial statement analysis, which involves studying

the financial reports of a company and learning how to extract

information from financial reports.

We start with some basics.

A company is owned by its shareholders.

In return for investing in the company, the shareholders

expect a return.

This return can come in the form of dividends, stock

repurchases, or capital gains.

The higher the return, the greater the value created by

the company.

A quote attributed to Warren Buffet asserts:

“Never invest in a business that you do not understand.”

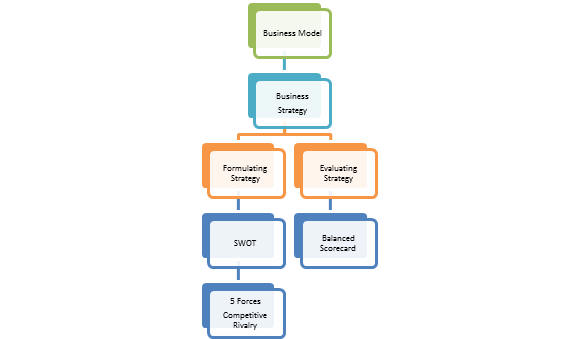

Today this quote is in danger of becoming a cliché, however if

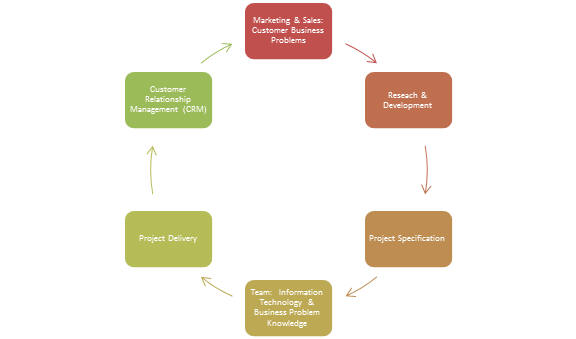

you apply the conceptual framework in figure 1, you will gain

insight into the quote’s intended original meaning.

That is, understanding a business starts with

understanding a firm’s business model and then learning how to

identify and evaluate a firm’s business strategy.

Figure 1 summarizes this process and includes two

important tools designed to help you achieve this objective by

helping you to gain insight into how business strategy is

formulated, communicated and evaluated.

These tools are “SWOT” and “Balanced Scorecard” analyses.

Figure 1:

Understanding the

Business

Overview of Understanding the Business

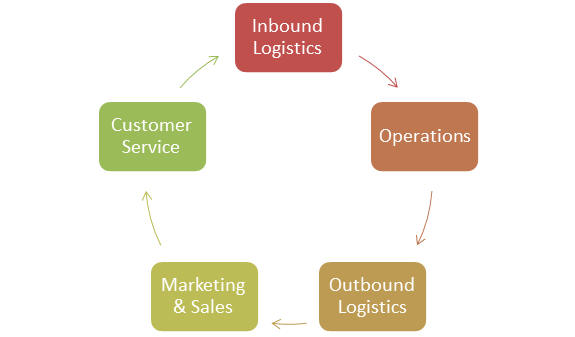

First, the business model describes how the company builds

shareholder value.

In order to become better acquainted with the business model we

will represent in terms of Porter’s Value Chain which depicts

the set of primary value adding activities required by the

model. Second, a

firm’s business strategy, which describes how a firm implements

it’s business model, can also be understood relative to the

firm’s value chain.

In this case the business strategy identifies which value adding

activities are emphasized relative to others.

This may imply that some of these activities are

outsourced or even eliminated relative to competitive rivals.

Identifying and understanding a firm’s business strategy from an

analyst’s perspective, is not easy.

In the following sections we approach this problem by

providing a set of operational steps that if followed, provide

rich insights into identifying and understanding a business from

this perspective.

First, it is useful to perform a “SWOT” analysis.

That is, an analysis of the

Strengths and

Weaknesses which are

internal to a firm, and an analysis of the

Opportunities and

Threats that are

external to the firm.

The external analysis requires an assessment of the

degree of competitive rivalry faced by the firm.

A SWOT analysis is a key component for formulating

strategy because it forces management to consider both the

internal and external environments that the firm’s business

model is implemented in.

Just as SWOT is useful for

identifying and

formulating a firm’s business strategy, a Balanced Scorecard

analysis is a useful tool for

communicating and

evaluating a firm’s business strategy.

We now illustrate these important steps that need to be

taken in order to understand a business.

Step 1: The

Business Model

The first step is to understand what a company does

to create shareholder

value. This is

called the business model.

For example, a company could decide to produce cars,

computer chips, or operate retail stores.

This information is disclosed in the company’s annual

report; and in the United States a publicly traded company must

file such a report with the Securities Exchange Commission

(SEC). The SEC’s

website summarizes the filing requirements as follows:

“The federal securities laws require publicly traded companies

to disclose information on an ongoing basis. For example,

domestic issuers (other than small business issuers) must submit

annual reports on Form 10-K, quarterly reports on Form 10-Q, and

current reports on Form 8-K for a number of specified events and

must comply with a variety of other disclosure requirements.

The annual report on Form 10-K provides a comprehensive overview

of the company's business and financial condition and includes

audited financial statements.”

(http://www.sec.gov/answers/form10k.htm)

Here are three examples that cover retailing, manufacturing and

services, taken from 2010 10-K filings:

•

“Wal-Mart Stores, Inc. (“Walmart,” the “company” or “we”)

operates retail stores in various formats around the world and

is committed to saving people money so they can live better.”

•

Intel Corporation:

“We develop advanced integrated digital technology, primarily

integrated circuits, for industries such as computing and

communications. Integrated circuits are semiconductor chips

etched with interconnected electronic switches. We also develop

computing platforms, which we define as integrated hardware and

software computing technologies that are designed to provide an

optimized solution.”

•

IBM Corporation: :

“The company creates business value for clients and

solves business problems through integrated solutions that

leverage information technology and deep knowledge of business

processes. IBM solutions typically create value by reducing a

client's operational costs or by enabling new capabilities that

generate revenue. These solutions draw from an industry leading

portfolio of consulting, delivery and implementation services,

enterprise software, systems and financing. “

You can see that each of these companies state quite precisely

what they do; one operates retail stores, Intel produces

computer chips (integrated circuits) and computing platforms and

IBM provides innovative solutions that exploit cutting edge

technology to their clients.

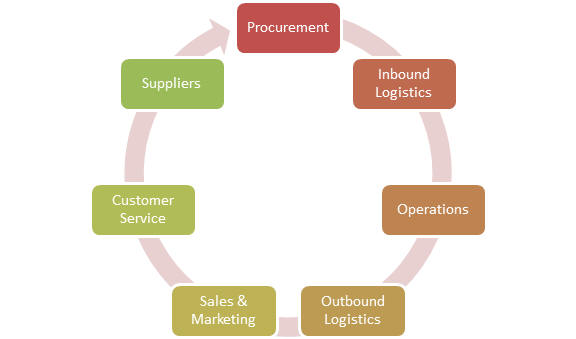

Representing the Business Model as a Value Chain

An important concept, due to Porter (1985), is called the value

chain which is defined from the firm’s business model.

This tells you the sequence of activities the company

performs so you can see what the firm does; this lets you see

where it is weak and where it is strong.

For example, think of a bookseller.

Given their assets (e.g., the store), the activities will

consist of buying books from publishers (procurement), internal

operations (receiving the books, putting them on the shelves,

paying bills), marketing and sales (advertising, store displays,

helping people find books), and customer service (special

orders, returns). The

activities help you decide what to look for when identifying

their business strategy and evaluating their performance.

In this example, some the important business ratios are

fairly evident: return on assets is a broad measure of

profitability, and clearly you would be interested in the

average number of days it takes for inventory to turnover.

In Porter’s original formulation a typical chain was depicted as

follows:

Since Porter’s original formulation of the Value Chain in 1985,

there have been many technological innovations including the

emergence of real time databases that have had a profound impact

upon value chains.

As a result, information flows drive today’s value chains and

technology is applied to squeeze out efficiencies that were not

available in 1985. For

example the rise of Supply Chain Management (SCM) and Customer

Relationship Management (CRM) techniques, that exploit real time

access to information throughout the entire chain, make the

entire chain very dynamic.

This has led to some activities initially classified by

Porter as support activities, becoming primary activities for

some businesses.

For example, in SCM procurement is a primary activity.

Similarly, it has also led to the chain truly becoming a

“chain.” For

example, CRM is designed to maintain ongoing relationships with

clients so the links form into a chain.

We now consider two examples illustrating these points.

Earlier part of the Item 1 10-K descriptions were provided for

IBM and Wal-Mart.

Consider, Wal-Mart first.

Porter’s generic description is applicable with the

following modifications:

Figure 2, A Value Chain for Wal-Mart

Supply chain management is critical to Wal-Mart and as such

there is an extended relationship with Suppliers that is linked

via databases.

Similarly, the Procurement activity is key to Wal-Mart for

supporting everyday low pricing.

This is reinforced in Wal-Mart’s 10-K when describing

their executive officer titles (Item 4):

“Executive Vice President, Chief Information Officer. From

February 2003 to April 2006, he served as Executive Vice

President, Logistics and Supply Chain.”

On the other hand Customer Relationship Management is important

to IBM and their value chain will look very different to

Wal-Mart. For

example procurement is not an important activity to IBM.

Figure 3: A Value

Chain for IBM

Becoming acquainted with the company’s Business Model at the

above level is an important necessary step that facilitates

identifying and understanding a company’s business strategy.

The best starting place for becoming acquainted with a

firm’s business model and business strategy is the firm’s 10-K,

and Valuation Tutor makes this immediately available to you by

entering the stock ticker.

Once you are able to represent a firm’s business model in terms

of a value chain you are now in a position to become acquainted

with the firm’s business strategy.

Step 2: Business

Strategy

The second step is the business strategy.

This summarizes how the company intends to implement its

business model to create shareholder value.

One way you can think of the difference between the

business model and the business strategy is that the model is

what it wants to do to create shareholder value and the strategy

is how it plans to do it.

An important part of the strategy is how it plans to

compete with other companies and as such, the degree of

competitive rivalry a firm faces is the major driver of the

design of a firm’s business strategy.

For example, business strategy is not important to a gold

miner whereas it is most important to a Wal-Mart, Intel or an

IBM as again the 10-K report reinforces.

For our three examples Item 1 contains the following:

• Wal-Mart: “We earn the trust of our customers every day by

providing a broad assortment of quality merchandise and services

at everyday low prices (“EDLP”) while fostering a culture that

rewards and embraces mutual respect, integrity and diversity.

EDLP is our pricing philosophy under which we price items at a

low price every day so our customers trust that our prices will

not change under frequent promotional activity”

• Intel Corporation: “We design and manufacture computing and

communications components, such as microprocessors, chipsets,

motherboards, and wireless and wired connectivity products. Our

platforms incorporate software to enable and advance these

components. We strive to optimize the overall performance of our

products by improving energy efficiency, seamless connectivity

to the Internet, and security features. Improved energy

efficiency is achieved by lowering power consumption in relation

to performance capabilities, and may result in longer battery

life, reduced system heat output, power savings, and lower total

cost of ownership. Increased performance can include faster

processing performance and other improved capabilities, such as

multithreading, multitasking, and processor graphics.

Performance can also be improved by enhancing interoperability

among devices, storage, manageability, utilization, reliability,

and ease of use.”

For the case of IBM they explicitly discuss strategy in Item 1

of their 10-K, under the heading Strategy:

IBM Corporation:

STRATEGY

“ Despite the volatility of the information technology

(IT) industry over the past decade, IBM has consistently

delivered superior performance, with a steady track record of

sustained earnings per share growth. The company has shifted its

business mix, exiting commoditized segments while increasing its

presence in higher-value areas such as services, software and

integrated solutions. As part of this shift, the company has

acquired over 100 companies this past decade, complementing and

scaling its portfolio of products and offerings.

IBM's clear strategy has enabled steady results in core

business areas, while expanding its offerings and addressable

markets. The key tenets of this strategy are:

• Deliver value to enterprise clients through integrated

business and IT innovation

• Build/expand strong positions in growth initiatives

• Shift the business mix to higher-value software and services

• Become the premier globally integrated enterprise

These priorities reflect a broad shift in client

spending away from "point products" and toward integrated

solutions, as companies seek higher levels of business value

from their IT investments. IBM has been able to deliver this

enhanced client value thanks to its industry expertise,

understanding of clients' businesses and the breadth and depth

of the company's capabilities.

IBM's growth initiatives, like its strengthened

capabilities, align with these client priorities. These

initiatives include Smarter Planet and Industry Frameworks,

Growth Markets, Business Analytics and Cloud Computing. Each

initiative represents a significant growth opportunity with

attractive profit margins for IBM. “

Again, the three strategy descriptions illustrated above for

Wal-Mart, Intel and IBM, are fairly simple: one strives for

consistently low prices, one strives to improve performance, and

the third innovates and transforms these innovations into

providing solutions for their clients.

It is clear that if each of these entities perform these

tasks well and better than their competitors, they will build

shareholder value.

Business Strategy and the Value Chain

Observe in the previous topic on Business Model that the set of

major value adding activities are identified, but there was no

attempt to identify what relative weighting was placed on each

of the activities.

For example, consider the following value chain that is equally

applicable to two competitive rivals, Coca Cola and PepsiCo:

Figure 4: Value

Chain for Coca Cola and PepsiCo.

From a business strategy perspective prior to the fourth quarter

of 2010 these two companies placed very different weights on

these activities.

Coca Cola outsourced Outbound Logistics whereas Pepsico retained

outbound logistics.

This difference abruptly changed when Coca Cola announced on

February 25, 2010 that it had agreed to acquire the North

American bottling plants.

From the perspective of the above chain this placed

weight upon

Outgoing Logistics plus it also placed increased weight upon

Sales and Marketing because now Coca Cola had much quicker

access to local information and flexibility to match regional

promotions run by PepsiCo in local supermarkets and other

outlets.

From an operational perspective, Business Strategy can be

defined directly in terms of the activities on a value chain.

In particular,

strategies tend to fall within one of three types.

A firm may choose to perform:

i.

Different activities to their rivals

ii.

The same activity in different ways

iii.

Choose not to perform an activity

For the case of our Coca Cola and PepsiCo example, prior to 2010

they competed in terms of iii. but this placed Coca Cola at a

disadvantage to PepsiCo in terms of their marketing and sales.

That is, they lacked the flexibility and the real time

information provided from controlling the bottling and

distribution operations at a regional sales and promotions

level. Post the

acquisition, the competitive strategy intensified with respect

to Marketing and Sales activity ponce Coca Cola has control over

these elements of the value chain..

Similarly, for the case of i, above, Amazon and Wal-Mart are

competitive rivals but Amazon places total emphasis on the world

wide web and cloud computing whereas Wal-Mart places their major

emphasis on “bricks and mortar.”

For the case of ii, Wal-Mart and Target are competitive rivals

and both emphasize “bricks and mortar.”

However, these two entities perform the same activities

in different ways.

Wal-Mart emphasize every day low pricing and Target emphasize

shopping experience.

Finally, we have already seen that IBM has shifted away from

producing from highly commoditized products (e.g., PC’s) towards

providing innovation solutions to their clients consistent with

their advertising theme of “making the world work better.”

That is, they chose not to perform certain activities in

their current business strategy.

The above examples, are designed to illustrate how the value

chain lets you represent both the business model and the

business strategy of a firm.

For the case of the former all major value adding

activities are required and identified.

For the case of the latter the relative importance of the

links must be identified.

Once you are familiar with the firm at this level then

you are able to interpret the results from financial statement

analysis in a much more meaningful way.

But first, there are two other important dimensions to business

strategy as indicated in Figure 1.

These are formulating strategy and evaluating strategy.

Formulating Business Strategy and SWOT Analysis

A strategy cannot be formed in a vacuum, and its effectiveness

will depend on various factors, both internal to the firm and

external to the firm.

One way to think about these factors goes by the acronym

SWOT: “Strengths,

Weaknesses, Opportunities and Threats.”

Remember that a financial statement only reflects what

happened in the past and thus by the time a competitive threat

facing a company actually starts affecting the financial

statement, it may be too late.

For example, historically IBM was a major driver of the

development and marketing of typewriters.

In 1933 Thomas J. Watson, Sr., IBM's founder and first

president, purchased the production facilities, tools and

patents of a small early producer of typewriters, a company

named Electromatic. IBM was only 20-years old at the time and it

put its development, production and marketing know-how into

perfecting an electric typewriter.

This ended up revolutionizing the typewriter industry.

Over time technology and the competitive rivalry changed and

this resulted in IBM selling it’s typewriter division in 1990 to

Lexmark whilst it still had some value.

The importance of SWOT is to help management make

strategic decisions even when they result in a major direction

shift for the company.

Just as Thomas J. Watson in 1933 made a bold strategic

move based upon his assessment of future developments, under

John Akers IBM made a significant strategic mode in eliminating

this division in 1990.

But then IBM was thrown into turmoil by the revolution

that took place with PC’s and the back office linking PC’s in

the early 1990’s. IBM suffered because it’s then strategy failed

to emphasize customer relationships.

This all changed with the arrival of Louis V. Gerstner

Jr., as the first CEO hired from outside since Thomas J. Watson,

Sr.,. Again this

resulted in a major strategic shift for IBM.

For the case of Gerstner he shifted IBM’s emphasis back

to the customer resulting in large amounts of shareholder value

being added to IBM.

IBM is not an isolated example.

Another more recent example of external threats and

strategic responses is the electronic book reader.

Once these became widespread after Amazon popularized

it’s Kindle, traditional booksellers could be out of business

very quickly. This

actually happened for the case of Borders whereas Barnes and

Nobel was able adjust their strategy to embrace this new model.

SWOT analysis is designed to avoid this type of worst case

scenario by identifying threats and reformulating strategy.

The Internal Analysis that arises from SWOT usually

result from traditional financial statement analysis.

The External Analysis components of SWOT often result

from Porter’s Five Forces Framework, described in the next

topic.

What is SWOT Analysis?

•

Internal Analysis

•

Strengths:

What are the firm’s comparative advantages over others in the

industry?

–

Best product, cool products (strong consumer ratings), 1st

mover advantage, strong balance sheet, strong innovation, strong

CEO e.g., IBM’s L.V Gerstener Jr first CEO hired from outside of

IBM since Thomas J. Watson Sr.,.

•

Weaknesses:

What are the firm’s comparative disadvantages relative to

others.

–

Is it too dependent upon a CEO when they stand down (e.g., KO’s

Roberto C. Goizueta 1981-1997, Steve Job’s Apple), weak balance

sheet, weak product lines (bad consumer ratings), little

innovation

•

External Analysis

•

Opportunities:

external opportunities for growth

–

IPAD (Apple and Microsoft – the latter passed it over after

developing it first)

•

Threats:

external threats in the environment that can result in

negative growth

–

Smart Phones which has nearly knocked out Nokia, e-readers which

did bring down Borders

•

External Analysis often starts from Porter’s Five Forces

Framework, described next.

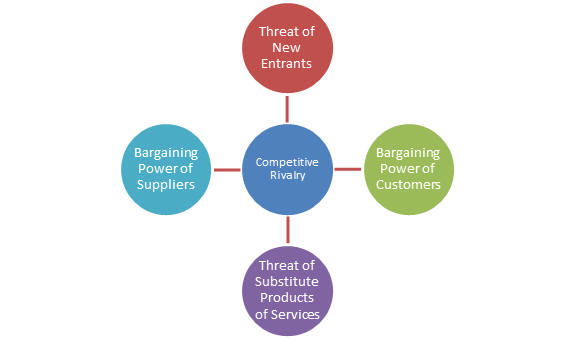

External Analysis and Porter’s Five Forces Framework

This was first presented in 1979 in a Harvard Business Review article titled: “How Competitive Forces Shape Strategy.” It identified the following forces as driving competition among firms in a given industry. These forces are:

Figure 5: Porter’s

Five Forces

Together the first four forces determine the Competitive Rivalry

within an Industry.

Porter argued that collectively these five forces determine the

ultimate profit potential of the industry and the essence of

business strategy is dealing with competitive rivalry. This in

turn means that these five forces plus the business strategy

should be reflected in profitability measures for industries as

reflected in aggregate financial statements.

Valuation Tutor allows you to perform this type of

analysis across sectors and industries for a wide ride range of

profitability measures.

The above discussion has been aimed at developing your skills

for identifying and

understanding a firm’s business strategy.

In the next section we introduce a tool that is used to

communicate and evaluate

a firm’s business strategy.

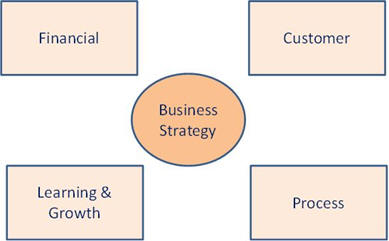

Business Strategy and the Balanced Scorecard Analysis

Another technique that is designed for both communicating and

evaluating a firm’s business strategy is called the “balanced

scorecard.” It

takes a broader view and looks at both financial and

non-financial measures.

It looks at a company from four perspectives: financial

(items like earnings), customer satisfaction, business process

(which includes the activities performed by the firm), and

“learning and growth” which tries to measure innovation (and

therefore is a way to think about the future prospects of a

company). The

Balance Scorecard explicitly considers how the firm’s business

strategy impacts upon these four perspectives.

Figure 6: The

Balanced Scorecard

The balance scorecard represents business strategy in terms of

four perspectives:

•

“Financial” perspective requires looking at measures that

are relevant to the valuation of the company by shareholders.

•

“Customer” perspective requires the identification of

performance metrics that measure the company’s success in

meeting customers’ expectations viewed from the customer or

outsider’s perspective

•

“Process” perspective refers to the internal

activities performed by a firm – business efficiency

•

“Learning and Growth” perspectives refer to employee and

informational activities requiring innovation and continual

improvement.

Combined this allows for both the communication and evaluation

of a business strategy at different levels of the organization

and in this capacity is a popular topic in a management

accounting course.

Management accountants design a comprehensive set of performance

measures (both financial and non-financial) to measure the

impact of the business strategy upon the different parts of the

organization.

From an analysts’ perspective this provides a useful framework

for assessing the effects of a business strategy. This is

because the effectiveness of a business strategy will eventually

show up in the financial statements and supporting notes to the

accounts.

For example, consider a firm that produces a great product but

poor customer service.

After some time, you would expect this to be reflected in

sales. Similarly, a

company that does not invest in learning and growth will

eventually lose competitive advantage, and this will be

reflected in its financial performance.

In our earlier example, for Coca Cola pre and post the

acquisition analysts will be evaluating the impact upon three of

the above four dimensions.

First, the new strategy has placed more emphasis upon the

Process dimension and evaluating the business efficiency of this

dimension becomes important.

In turn this allows more emphasis to be placed upon the

customer because of the greater access to information and

flexible scheduling at the regional level.

This will be reflected in sales and marketing.

Finally, at a combined level the overall effects of this

investment decision will be reflected in the financial

dimensions.

The above discussion makes clear that a full evaluation of a

company cannot take place with just one year’s financial

reports; how various ratios change over time is also important.

In financial statement analysis, looking at performance

across time is called “horizontal analysis.”

Step 3: Financial

Statement Analysis

This leads us to the two main questions posed in the book:

•

How do we measure how well they are performing in these

tasks, i.e., how successful are they in implementing their

business model?

•

How much value are they creating, i.e., what is it worth?

These are answered in two ways: the first uses financial

statement analysis, the second calculates an intrinsic value for

a company using valuation models.

An overview of valuation models is in the next section.

In this section, we focus on financial statement

analysis.

Let us start with measuring performance.

One way is through financial statement analysis, which

actually encompasses different methods, including ratio

analysis, common size analysis, and activity analysis.

Ratio analysis involves studying the financial reports of

a company to understand its strengths and weaknesses.

It lets you analyze a company’s performance along

multiple dimensions.

For example an important ratio in financial statement

analysis is return on assets, or ROA, defined as profits divided

by total assets.

Total assets are defined as everything the company owns that can

be used to produce income, and therefore measures the resources

that are available to the company’s managers. ROA measures how

productively the assets are being converted into profits.

Ratios such as ROA also provide a basis for comparing

companies.

There are many forms of ratio analysis.

The origins of ratio analysis can be traced back to bank

lending, which used such as the current ratio (which measures

the company’s ability to pay back its short term debt).

At the beginning of the 20th century, the DuPont model

became a popular way to analyze performance; it consists of

decomposing ROA into three sub ratios.

Ratios are typically classified by what they are trying

to measure. For

example, liquidity ratios (such as the current ratio) measure

the ability to pay back short term liabilities.

Solvency ratios measure the ability to pay back long-term

debt. Profitability

ratios (such as ROA) measure how well the company creates

profits from its operations.

Activity analysis ratios (such as the inventory turnover

ratio described below) measure how well the company is managing

its resources.

A ratio such as ROA is a broad measure.

You could also look more deeply into how the profit (also

called the net income) is created from the total assets.

One ratio that gives you deeper insight is called the

degree of operating leverage, which measures how sales are

converted into profits.

Analysis of working capital provides more insight; it

deals with short term operations.

For example, you could look at the inventory turnover

ratio, which tells you how quickly you are selling products.

Other ratios give you insight into how it might perform

in the future. For

example, the current ratio tells you something about a company’s

financial strength; it measures the ratio of current assets

relative to its liabilities.

If you have too many liabilities relative to your assets,

your future prospects may not be as bright as those of other

companies.

Interestingly, this was one of the earliest ratios used by U.S.

commercial banks in the 1890’s when they requested financial

statements from companies wanting to borrow money (see Horrigan

1968).

In summary, ratio analysis provides you with a way of measuring

performance and also provides a way to compare performance

across firms. But

the ratios cannot be interpreted in a vacuum; it is important to

know the business model (what the company does) and the strategy

(how it plans to do it).

For example, consider a web design company and a

retailer, who have very different business models. For the

retailer, it makes sense to want a high inventory turnover; you

do not want products sitting on a shelf or in a warehouse.

But for the web design company, there is no real

inventory that is being sold.

So comparing these two very different companies along

this dimension is not very useful.

Common Size and Activity Ratio Analysis

Financial statement analysis encompasses other techniques as

well. These include

Common Size Analysis and Activity Analysis.

Vertical Common Size analysis re-expresses the major

financial variables to make them comparable across companies by

adjusting for size.

For example, suppose company 1 has $1b in assets and another has

$10m in assets.

Simply looking at their earnings would not give you much

information. But if

you divide earnings (and all other variables, such as sales) by

assets, you can get a more meaningful comparison of the

companies. In fact,

recent research has shown that investment divided by total

assets can tell you a lot about stock returns and how stocks

prices react to earnings announcements made by firms (Chan,

Novy-Marx, and Zhang (2010) and Wu Zhang and Zhang (2009).

Horizontal Common Size analysis is similar, except that it

adjusts for time by re-expressing the variables in terms of a

base year. So

current variables are then percentage changes from the base

year, and this lets you see how fast different variables are

growing. This is

especially useful in evaluating the effects of a change in

business strategy.

In any analysis of a company, business strategy matters.

Consider a luxury retailer, who sells a few high price

items during a year, and a discount retailer, who sells lots of

inexpensive products.

Both are retailers, but they have different business

strategies. And we

expect their ratios to reflect that: one should have a higher

profit margin than the other. If the luxury retailer has low

profit margins (profit divided by sales revenue) and low

inventory turnover, it is not performing very well.

We expect the discount retailer to have a low profit

margin (after all, that’s what discount means!) but to make it

up in volume, i.e., have a high inventory turnover.

So how do you know what to look for?

This can be complicated.

After all, the operations of a large multinational

company can encompass many different activities.

How do you think about the business model and strategy of

such a company in a manageable way?

Over the years, different methods have been developed for

broadly classifying models and strategies.

These methods give you a framework for thinking about a

company without having to work through every detail of the

company’s operations.

We cover some of these in Chapter 4, and give you a brief

overview here.

Major Firm Decisions

Having decided on a strategy, a company carries it out by making

different types of decisions. In the case of our bookstore,

there are many such decisions.

For example, should you focus on more expensive hard

cover books (which generate more profits per book but sell fewer

copies) or on paperbacks?

How much should you spend on employee training so they

can help

customers? Should

you advertise or rely on people walking by?

How many discounts should you offer?

Should profits be used to expand or be paid out to the

owners? Should you

borrow from a bank to finance operations or only use the owner’s

capital?

These are all strategic decisions.

Usually, they are separated into three categories:

·

The investment decision: any decision that has to do with

allocating resources.

For example: whether to invest in a new computer system

that can make tracking inventory and sales more efficient.

·

The financing decision: how to pay for operations and expansion.

For example: borrowing from a bank, issuing bonds,

issuing shares.

·

The dividend decision: how much of the profit to pay to

shareholders

In Chapter 4, we will describe these decisions and their

relationship to the business strategy of different companies.

But we should mention that in recent years, more and more

attention is being paid to another important decision: the risk

management decision.

Pretty much every business model entails some risk.

These risks come from several factors, including general

economic factors such as a slowdown or expansion of the economy,

global events such as wars, financial factors such as changes in

interest rates or exchange rates, and technological changes.

But by thinking about the risks that matter most to your

business, you can decide what risks you do not want to take.

A simple example is using financial derivatives to hedge

interest rate or exchange rate risk.

A more complex example is to locate your manufacturing

plants in different countries to diversify the risk of political

upheavals.

The results of the decisions a company makes are reflected in

their financial statements.

In Chapter 3, we introduce tools used by analysts and

management to analyze the performance of the firm's investment

decision. In

Chapter 3, we study how the market “values” the firm’s

investment decisions.

This links the internal assessment to the external

assessment; you could think you are doing well, but investors

may not agree.

Chapter 3 also introduces ratios that result from the firms

financing and dividend decisions, and in Chapter 5, we again

look at how the market views these results.

The primary ratio that reflects the investment decision is the

Return on Assets (ROA), defined as the ratio of Net Income to

Total Assets. This

basically measures how much profit is being generated by the

assets.

The financing decision is reflected in what is called the

Financial Leverage Ratio (FLR).

This is the ratio of Total Assets to Shareholders Equity.

The latter measures the capital of the firm “owned” by

the shareholders, formally defined as the difference between

Total Assets and Total Liabilities.

If the Financial Leverage Ratio is high, then a

relatively small percentage of the assets are owned by the

shareholders, and so the rest of the assets have been obtained

by borrowing.

The product of ROA and the Financial Leverage Ratio is called

the Return on Equity (ROE); it is the ratio of Net Income to

Shareholder’s Equity, and therefore measures how much profit is

being generated per unit of the capital of the firm that is

owned by the shareholders.

The dividend decision is reflected in the Retention Ratio (RR),

which is the percentage of earnings that is retained by the

firm. One minus the

Retention Ratio is called the Payout Ratio, and is the

percentage of earnings that are paid out as dividends.

The three decisions come together in the definition of what is

called Fundamental Growth (or

Accounting Growth):

Fundamental Growth = ROE * RR

In Chapter 4, we will explain what this is in detail, but for

now, note that it can be written as:

Fundamental Growth = ROA * FLR * RR

This quantity therefore reflects all three decisions.

In turn, each of these ratios can be decomposed further,

providing more insight into the effectiveness of a firm’s

strategy. These

include Working Capital Ratios, Cash Management and Liquidity

Ratios, Activity Analysis of Operations, Profitability Ratios,

Solvency Ratios. The details of all these, and their

interpretation in light of a company’s business strategy, are

the focus of Chapter 4.

In summary, the financial statement analysis part of Valuation

Tutor proceeds as follows.

In Chapter 2, we show you how to get company filings from

the SEC site, and explain the various financial statements.

In Chapter 3, we develop the ratio analysis, complete

with examples and a detailed explanation every calculation

performed by Valuation Tutor. This reconciliation is critical to

understanding some of the nuances that arise and some of the

assumptions and judgments that have to be made in the analysis.

Chapter 4 focuses on the interpretation of results to help you

understand how ratio analysis can be used to evaluate and

compare firms.

Finally, Chapter 5 extends the analysis to price based ratios.

This chapter asks how the market view performance along

the dimensions identified in Chapter 3.

This is important for what is called relative valuation.

The most popular price based ratio is the Price to

Earnings (P/E) ratio, which measures how “valuable” the earning

of a company are.

But there are many other ratios as well, and you will see how to

use them in Chapter 5.