Trading Case XR1

Case Objective

To understand using options

and futures to manage currency risk; to understand options trading strategies.

Key Concepts

Currency option and futures

pricing; option hedge parameters. Delta hedging

Case

description

Financial markets have

become increasingly global and the need to manage exchange rate risk has become increasingly important. Trading case XR1 introduces you to using some

of the tools and trading strategies that get employed in the field. See the appendix to this case for Trading

Tips on this case.

"Private" Information

In this market you are a price-taker. That is, you can trade options and a future

at the current available price. You

have, however, some additional private information that has not been incorporated

into the available derivative prices.

Your information is that

you know for sure that at some time during the trading trial the exchange rate

will take a significant "jump."

However, the magnitude, direction and timing of the jump is random. In

addition, once a jump is realized it is possible that additional independent

jumps can occur.

In the XR1 trading

exercise your objective is to make money.

As a result, you should think through what type of option trading

strategies can best exploit your knowledge of how the trading period will

unfold. If at any time you want “lock

in” trading gains you can always manage the delta of your position to try and

do this. For example, a delta neutral

position manages the exposure of your position to changes in the underlying

exchange rate.

As a trader, your

performance is measured in terms of how well you use this information for

trading, relative to all other FTS

traders.

Trading Screen

Each trader's screen will

monitor the following markets: the spot exchange rate (S) for a basket of foreign currencies (bfx). In particular, the exchange rate is 500 units

of the basket (bfx) for x units of USD, where x will

fluctuate in line with the spot exchange rates.

The default free US treasury strip with 2 years remaining to maturity at

the start of the trading period, European call and put options on the exchange

rate for two different strike prices, an exchange rate futures market, and a

cash money market.

Definition of A Trading Trial

One trial in this case is

almost 12 months, but time is condensed so that two weeks is equal to “n”

seconds. That is, throughout the trial

trading is continuous but prices will change in discrete time, two week steps

every “n” seconds of FTS time. That is,

in calendar time the markets are open for FTS traders on the first trading day

of every two weeks.

Note: In the

default form of the case “n” seconds equals 20.

The following table

describes price changes in this market:

|

Calendar Time |

Real-time |

|

|

|

|

Day 1, Week 1 |

Time 0-20 seconds |

|

Day 1, Week 3 |

Time 21-40 seconds |

|

Day 1, Week 5 |

Time 41-60 seconds |

|

....................... |

............................... |

New prices are realized

for each trading Day (20 second interval).

Prices reflect the underlying difference in calendar time. That is, the Treasury Strip appreciates

toward its face value over time, and option prices reflect the time left to

maturity etc.

Market Environment

The first market is the

exchange rate. This is the value of 500 bfx in $US. Analyst

research has indicated that the statistical process that approximately

describes the behavior of this exchange rate is a geometric Wiener process with

the following properties:

|

Outside Market's Projected volatility of return () |

12% per annum |

|

Spot Index Value (Bid/Ask) |

Near 300 |

|

Projected Drift () |

0.0% per annum |

|

Unit of Time |

2 week (20 seconds) |

|

Eurodollar rate US |

0.03 |

|

Euromark rate |

0.07 |

The projected volatility

is a little above historical averages for volatility

but well below the heights reached in the European currency crisis in 1992.

Time

Two weekly bid and ask

realizations for the spot exchange rate are updated every 20 seconds on the FTS

trading screen. The size of the spread in this market is stochastic.

At the end of the year ( = one trading trial), your currency position is

marked-to-market at the prevailing rate.

Other Financial Contracts

The second security

market is a risk-free

Securities 3 through 6

are European currency options (put and call) defined on the underlying spot

exchange rate. The strike or exercise

prices for these options are 290 and 310 (in $US). That is, the call option with a strike price

equal to 290 provides its owner with the right, but not obligation, to acquire

500 bfx for $US290 at the end of its life. The time to maturity for each option in the

FTS markets is initially 1 year and declines every second until the options

expire.

The terminal payoff for

each option depends upon the realized exchange rate after the FTS markets are closed

(i.e., at the end of the year). Thus,

the 290 Call and 310 Put have terminal values computed as follows:

Terminal Value:

![]()

![]()

At the end of their life

options are automatically exercised if they are "in the money."

Finally, the seventh

market is a currency market future. This

contract is an obligation to deliver 500 bfx in 52

weeks time.

Security Summary And Trading Restrictions

|

Financial Markets |

|

Spot x-rate (500 bfx) in $US (S) |

|

US Treasury Strip (maturity 104 weeks) |

|

52 week call on spot x-rate, Strike 290 |

|

52 week Put on spot x-rate, Strike 290 |

|

52 week Call on spot x-rate, Strike 310 |

|

52 week Put on spot x-rate, Strike 310 |

|

X-rate Future (500 bfx / 52 weeks) |

|

Money market (3% p.a.) |

You are not permitted to

trade directly in the spot x-rate market.

Stochastic Bid Ask Spread

In this case FTS traders

are market takers who face a stochastic bid/ask spread for each security. The mean of this spread approximately

coincides with theoretical prices (ignoring your private information). However, the range around the theoretical

price increases as we move from Treasury strips, exchange rates, exchange rate

futures, call options, to put options.

That is, on average the spread is the largest for currency put options

and smallest for the Treasury strips.

Initial Trader Positions

|

Type A |

Endowments |

|

Cash |

$114,000 |

|

Call 290 |

-2000 |

|

Type B |

Endowments |

|

Cash |

$127,300 |

|

Put 290 |

-2000 units |

Trading Restrictions

You cannot trade the

exchange rate.

You cannot trade the

option you have a starting position in.

That is, Type A cannot trade the Call 290 and Type B cannot trade the

Put 290 above.

You cannot trade lot

sizes that exceed 10000 units. However,

over time any quantity can be traded at the prevailing spot price by trading

multiple lots.

You can shortsell

securities or borrow cash at the prevailing interest rate to purchase

additional securities if you are short cash.

Any cash shortfall/surplus automatically earns the prevailing rate of

interest. The risk-free rate of interest

is 3% per annum (continuously compounded and marked each 20 seconds (two

weeks)). Your trading objective is to

earn as much grade cash as possible.

Earning Grade Cash

In the trading period

securities are exchanged using market cash.

A trading period lasts for 52 weeks of calendar time which is referred

to as one trial. Multiple independent trading trials will be

conducted. That is you will restart with

an initial endowment (that is either type A or type B) and an independent time

path for the exchange rate is generated starting from a spot value around

300. At the end of any trial you will

earn grade cash as follows:

![]()

The upper and lower bounds for market cash are

-$100 million and +$100 million. Outside

of these bounds no further Grade cash is earned or lost. Trading is conducted over a number of

independent trials and a record of your cumulative grade cash is maintained.

Linking to the

Trading Support

Download the trading support spreadsheet from the

Virtual Classroom page and open it in Excel.

Launch the FTS Trader and link to the market. In FTS Trader click on the File menu and

select Excel Link from the sub menu items.

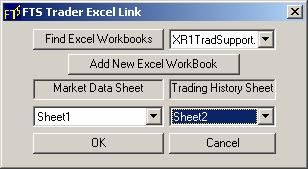

The following screen will pop up.

Select the spreadsheet titled XR1TradSupport and be sure to select Sheet

1 as the Market Data Sheet and Sheet 2 as the Trading History Sheet as depicted

below:

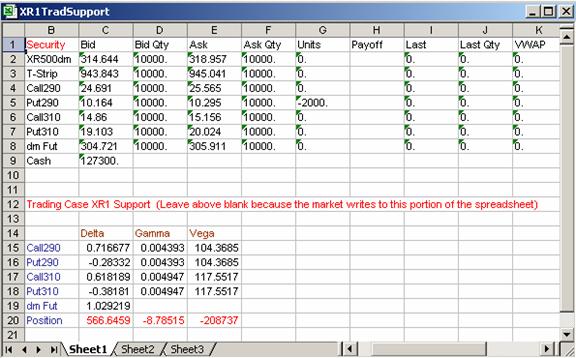

Click OK and the spreadsheet is automatically linked

to the market. By giving focus to the

spreadsheet (i.e., resize so it is on the same screen as your trading window),

you can see your position greeks

update in real time. The spreadsheet

support is illustrated below:

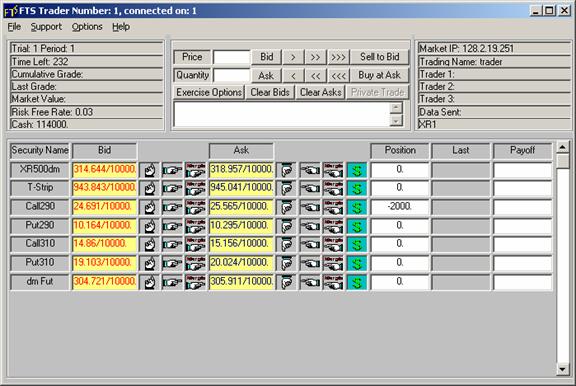

Corresponding Trading

Screen in the FTS Trader

Appendix

Trading Tips for Trading XR1

In

trading case XR1 you are a short term “news trader.” You have information that lets you form a

“market view” about the short term price behavior of the underlying exchange

rate. In XR1 the price of the underlying

exchange follows the geometric Brownian motion process assumed by Black and Scholes with one important difference. During the trading period at least one

significant economic news event will occur that will result in the price of the

exchange rate taking a jump. However,

you do not know when the jump will take place or it’s

magnitude and direction. In addition,

there may be more than one significant jump (but there will be at least

one). Unlike the real world you do not

face any liquidity or capital constraints.

You

have an initial position in an option that you cannot trade, but you can trade

the remaining derivatives (option and futures).

As a result, your task is to manage your trading strategy so that it

makes money if your view of the market is correct. At any time if you want to lock in your

trading gains you can also manage the delta of your position. By linking to the XR1 support spreadsheet

(you can download this from the Virtual Classroom page immediately below where

you download the FTS Trader from).

Why Delta?

Delta

is a measure of the dollar sensitivity of your position to changes in the

underlying (i.e., the exchange rate).

Formally, the delta of a derivative security is the partial derivative

(i.e., calculus) of the derivative security’s price w.r.t.

a change in the underlying asset price.

The delta of each security and your position’s delta are provided in the

support spreadsheet in real time.

Excel Note for FTS Trader: If Excel is set

to Automatic Calculate (Tools, Options, Calculations, Automatic) and you link

FTS Trader to this spreadsheet, it will automatically recalculate your position

delta whenever the exchange rate changes in XR1.

By

trading the options and futures you can manage your position delta to be

approximately zero, positive or negative.

For the case of a zero position delta your position’s value will be

relatively insensitive to shifts in the underlying exchange rate. If you assume a large positive position delta

your position will be very sensitive to shifts in the price of the underlying

(with increasing sensitivity the larger your position delta is). That is, if the underlying exchange rate

increases so does your position’s value and if the underlying exchange rate

decreases your position value will decline.

Finally, if you assume a large negative position delta then the value of

your position responds in the opposite way to the change in the exchange

rate. That is, if the exchange rate

increases your position’s value decreases and vice versa.

Finer points: Your position

gamma is a measure of how sensitivity your position delta is to changes in the

underlying. Formally, gamma is the

partial derivative (in calculus) of the derivative security’s delta w.r.t. the underlying asset price (i.e., the second partial

derivative w.r.t. the underlying asset price). In the field, suppose a dealer is hedging the

exchange rate risk by maintaining an approximate delta neutral exposure (i.e.,

position delta equals 0). If a dealer

maintains a gamma sensitive (i.e., large position gamma) position they must

adjust delta frequently and by larger amounts to maintain a zero position

delta. If a dealer maintains a gamma

insensitive position (i.e., approximately zero position gamma) then this

reduces the frequency and size of delta adjustments that need to be made to

maintain a zero position delta. In

practice by reducing the size and frequency of having to adjust your position’s

delta results in a source of significant transaction cost savings.

Finally,

your position Vega is a measure of how sensitive your position is to volatility.