Trading Case IN2

Case Objective

To understand the

relationship among private information, spot stock index prices and forward

stock index prices.

Case description

This case is identical to IN1

except that traders will receive private “analyst forecasts.” In this trading case you can trade in two

stock index spot markets and one stock index forward market. In each market you can i. submit limit orders

to buy/sell quantities up to 10000 units at a time, (i.e., make market) and ii.

submit market orders to buy or sell some quantity

(i.e., take market) up to what is currently available at the best bid or

ask. The former requires submitting bids

and asks to buy and sell, whereas the latter requires that you sell to a

prevailing bid or buy from a prevailing ask.

Short sales, and borrowing (lending) in the

money market are all permitted. Trading

takes place for the first day of the calendar year only. Any net surplus (deficit) of cash you end the

first trading day with accrues (pays) interest at the rate of 5% for the

remaining year (i.e., compounded annually).

Settlement in the forward market is at the end of calendar year. At this time your positions in the two index

markets are also marked to the realized end of year index value. That is, all positions are converted to cash

at the end of the calendar year and your trading bonus is determined.

Markets

The set of possible

realizations for the end of year realizations for each stock index are: {7900,

12100}. Each realization is equally

likely and the realization for index B is independent of the realization for

index A. During a trading session

multiple independent trials are conducted.

Trading Objective

Your aim is to make as much

money as you can and your trading bonus = 0.0001*total end of year market

cash. Your trading bonus is cumulated

across trials.

Private Information

You will receive, for each

index, forecasts of the end of year realized index value throughout the trading

day. The information is in the form of

the “true value” plus or minus some error.

The expected value of the error is zero but the realized error can be

positive or negative. Different trader

types get different unbiased forecasts so that in aggregate the market as a

whole always has better information than any individual forecast. In addition, information is such that you

receive forecasts with smaller errors as the period progresses.

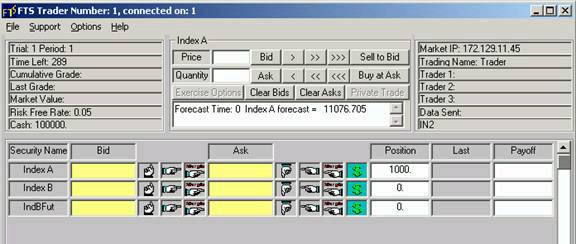

In the information text box

(a single click on each index security reveals the information in the

information text box) you may observe the following screen example:

Forecast Time: 0 Index A

forecast = 11076.705

This means that the forecast

became available immediately (0 -seconds after the start of the market) and

reveals that an unbiased estimate of the end of year index A

value equals 11076.705 for this particular trader. Other traders will have different unbiased

forecasts.

Forecast Error = (x –

0.5)*y(time), where x is a random number between (0,1) and y(time) is a scaling

variable that starts at 5000 for the first message and reduces as 4500, 4000,

3500, 3000, 2500, 2000, 1500, 1000, 500 for 10 updates over time. So the first error is quite large and

equals: realized value +/- 2500 shrinking down

to +/- 250.

The same type of information

structure is available for Index B.