Trading Case

IN1

Case Objectives

To understand the relationship between spot and

forward stock index prices. To examine

the potential impact that opening a forward market has on spot prices.

Case

description

In this trading case you can trade in two stock

index spot markets and one stock index forward market. In each market you can i. submit limit orders

to buy/sell quantities up to 10000 units at a time, (i.e., make market) and ii.

submit market orders to buy or sell some quantity (i.e., take market) up to

what is currently available at the best bid or ask. The former requires submitting bids and asks

to buy and sell, whereas the latter requires that you sell to a prevailing bid

or buy from a prevailing ask. Short

sales, and borrowing (lending) in the money market are all permitted. Trading takes place for the first day of the

calendar year only. Any net surplus

(deficit) of cash you end the first trading day with accrues (pays) interest at

the rate of 5% for the remaining year (i.e., compounded annually). Settlement in the forward market is at the

end of calendar year as described in the markets section. At this time your positions in the two index

markets are also marked to the realized end of year index value. That is, all positions are converted to cash

at the end of the calendar year and your trading bonus is determined.

Markets

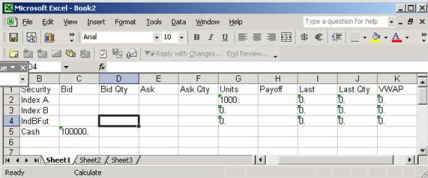

Opening Trading Screen

The opening screen appears as follows. The markets are described below.

Market 1 is called “Index A.” This market trades a basket of stocks that

exactly replicates a stock index called A.

At the end of the year this basket is marked to the realized value for

stock index A. Market 2 is called “Index B.”

This security is also a basket of stocks that exactly replicates a stock

index called B. Again at the end of the

year this basket is marked to the realized value for stock index B. Both markets A and B are spot markets and the

stock indices A and B are identical except for the fact that their realizations

are completely independent. That is, if

A is high then B can be any of the feasible values provided below.

Marked Value

for Index A and Index B

The set of possible end of year realizations for

each stock index are: {7900, 12100}.

Each realization is equally likely and the realization for index B is

independent of the realization for index A.

Market 3 is a forward contract

defined directly on index B. It is cash

settled at the end of the year and is quoted so that 1 forward contract

corresponds to 1 unit of index B.

Market 3: Forward Contract Long Forward Contract

Example

Suppose you could buy or sell the forward contract

at 10,000 during trading (day 1 of the year) and your current position in Index

forwards is zero. If you buy 1 unit of

the forward contract you are now long one contract and the following

transactions result:

Trading Day 1 of the Year: Cash balance is not affected by buying the

forward contract (i.e., zero cash is exchanged at the time of the trade). Units balance for the forward contract

increases by 1 (so current balance is +1 to reflect the long position).

End of the Year:

You are obligated to settle the forward contract at the price agreed to

at the time of trade (e.g., 10,000 in current example). Cash is reduced by 10,000 and in exchange you

receive 1 unit of the underlying index B.

This has a realized value = ST. So the net cash transferred into or from your

cash account is: ST –

10000.

Market 3: Forward Contract Short Forward Contract Example

Suppose you could buy or sell the forward contract

at 10,000 during trading (day 1 of the year) and your current position in Index

forwards is zero. If you sell 1 unit of

the forward contract you are now short one contract and the following transactions

result:

Trading Day 1 of the Year: Cash balance is not affected by selling the

forward contract (i.e., zero cash is exchanged at the time of the trade). Units balance for the forward contract

decreases by 1 (so current balance is -1 to reflect the short position).

End of the Year:

You are obligated to settle the forward contract at the price agreed to

at the time of trade (e.g., 10,000 in current example). Cash is increased by 10,000 and in exchange

you must give up 1 unit of the underlying index B. This has a realized value = ST. So the net cash transferred into or from your

cash account is: 10000 - ST.

It is your task, as part of the trading crowd, to

discover prices for the spot and forward markets during the first day's

trading. A trading session consists of

multiple independent trials. Your

trading bonus is cumulated across trials.

Trading Objective

Your aim is to make as much money as you can and

your trading bonus = 0.0001*total end of year market cash.

Spreadsheet

Support

Step 1: Linking

the FTS Market to your Spreadsheet

Performing spreadsheet link is

simple. First open Excel. In the FTS Trader click on the File Menu item

and then select Excel link.

Next click on the button Find

Excel Workbooks and then select the work book you want to link to. Be sure to link Market Data and Trading

History to two different sheets. Then

click OK. The link is automatically

maintained for you in real time.

Step 2: The fixed spreadsheet cell conventions

If you choose to create a spreadsheet support system

for this trading case the following cell information is relevant:

Suppose

you link to Sheet 1 and sheet 2 as per screen shot below. Sheet 1 maintains a real time link to your

trading screen. Spreadsheet Cols run

from A (blank), B (Security), C (Bid), D (Bid Qty) etc., and rows run from 1

(Headings), 2 (Security 1), 3 (Security 2), 4 (Security 3) etc., for all

securities in the case and then followed by your cash balance.

The above cells are fixed and

general across FTS cases. Once you have

linked to your spreadsheet (which you can do via the file menu item in the FTS

Trader), the first security’s bid comes into cell C2, and so on up until the

VWAP (current volume weighted average price of trades).

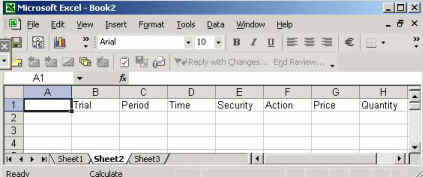

Sheet 2: Contains your personal trading

information. Spreadsheet Cols run from A

(blank), B (Trial), C (Period), D (Time) etc., and rows run from 1 (Headings),

2 (first trade), 3 (second trade), etc.,

The details for the second

sheet which contains your personal trading diary are provided below:

Tip: If you are involved in a weekend trading session it is

recommended that you have a third master sheet in your workbook to keep you

personal trading diary in. That is, if

you are logging in and out of the market multiple times you will need to keep

track of your cumulative trading diary because each time you log in the

personal trading diary starts from row 1 (as above) of the sheet you choose to

link to. As a result, if you log in and

out multiple times and want to maintain a cumulative trading record, be sure to

do either i. or ii. below:

i. Attach to a different Sheet each time so that

you have login 1, login 2 etc., recorded in separate spreadsheets or,

ii. At the time of logging out

copy and paste the data from Sheet 2 to Sheet 3 (assuming you have linked to

Sheet 2 as illustrated above). In this

way you maintain a cumulative record of your trading history in Sheet 2.

Tip: It is a good practice to back up

your Excel Workbook.