Trading Case FX3

Case

Objective

To understand no arbitrage relationships among exchange rates (spot and forward), interest rates (domestic and foreign) and currencies in terms of triangular arbitrage.

Key Concepts

Arbitrage free relationships, covered interest rate parity, triangular arbitrage, spot and forward exchange rates.

Case description

In this trading case you will trade in a mixed currency environment containing $USD, $AUD and EUR. You can have long or short positions in the securities traded, and different traders may have different positions. There are eight markets open that you can submit market and or limit orders to during the first trading day of a calendar year. At the end of this day time “jumps forward” and your position is marked to market in $USD using the realized end of year exchange rates. Both short sales and borrowing is permitted in all currencies and at the end of the year your position earns/pays any accrued interest resulting from your day 1 trading activities.

Markets

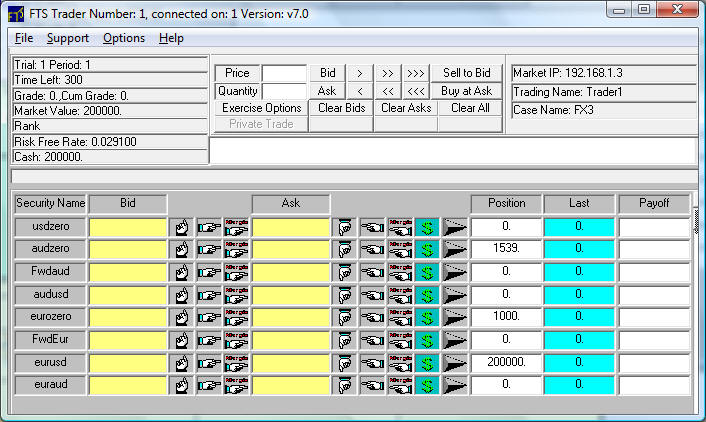

Opening Trading Screen

The opening screen appears as follows. The markets are described below.

Market 1 is “usdzero.” This market trades a zero coupon bond that pays $USD100 at the end of the year. Market 2 is a zero coupon bond, “audzero,” that pays at year end $AUD100. Market 3 is forward exchange rate market, “fwdaud,” that trades $AUD per 1 unit. That is, a limit order of 0.60/1 if hit implies that at the end of the year the bidder pays $USD0.6 to receive $AUD1. If the realized end of year exchange rate is 0.75 then the bidder pays $USD0.6 and receives $AUD1 which has a marked value of $USD0.75 per unit. As a result, the realized gain from this forward exchange rate transaction for 1 contract equals $USD0.15. If 10,000 units had been traded at this price the realized gain equals USD$1,500. Market 4 (audusd) is a spot exchange rate market. It is quoted in units of $USD per 1 $AUD. That is, a bid of 0.60/1 is a limit order that is offering to pay $USD0.60 for $AUD1. Traders can trade up to 10,000 dollars at a time (a click of the mouse). Market 5 is a euro zero coupon bond, “eurzero,” that pays at year end EUR100. Market 6 is forward exchange rate market, “fwdeur,” that trades EUR per 1 unit. That is, a limit order of 1.25/1 if hit implies that at the end of the year the bidder pays $USD 1.25 to receive EUR1. If the realized end of year exchange rate is 1.5 then the bidder pays $USD1.25 and receives EUR1 which has a marked value of $USD1.5 per unit. As a result, the realized gain from this forward exchange rate transaction for 1 contract equals $USD0.25. If 10,000 units had been traded at this price the realized gain equals USD$2,500. Market 7 (eurusd) is a spot exchange rate market. It is quoted in units of $USD per 1 EUR. That is, a bid of 1.30/1 is a limit order that is offering to pay $USD1.3 for EUR1. Traders can trade up to 10,000 dollars at a time (a click of the mouse). Finally, market 8 is a spot exchange rate market that trades euraud. A bid of 2/1 in this market is bidding $AUD2 for 1 EUR. The screen below illustrates the markets open.

Interest Rates

There

are three money markets in this case.

The first is your Cash account (see Cash: in the above screen with a

balance equal to 200000). This is

your current cash balance in USD.

The second, is the balance under Position beside audusd (balance equals 0

in the above example). This is your

current balance of cash in units of AUD.

Each

market is open for day 1 of the year. As a result, a long position in either

money market at the end of the trading day accrues interest for the year. Similarly, a short position in either

cash account, at the end of the trading day, pays the interest that accrues for

the year. During the trading day

balance fluctuations in either cash account do not attract interest accruals or

payments.

The set of possible realizations for the end of year cost of $AUD in units of $USD depends upon the path each economy follows throughout the year. In this case the possible exchange rate realizations for audusd lies in the following interval: [0.53, 0.80]. That is, the realized exchange rate is any number between 0.53 and 0.80 with each possible realization being equally likely. Similarly, the possible realizations for the eurusd lies in the interval [1, 1.5]. Again each realization is equally likely. It is your task as part of the trading crowd to discover a price for the spot exchange rates plus the cross rate for the first day's trading.

Trading Objective

Your aim is to make as much money as you can which depends upon how well you trade relative to the prices discovered by the market.

Spreadsheet

Support

Step 1:

Linking the FTS Market to your Spreadsheet

Performing spreadsheet link is

simple. First open Excel. In the FTS Trader click on the File Menu

item and then select Excel

link.

Next click on the button Find

Excel Workbooks and then select the work book you want to link to. Be sure to link Market Data and Trading

History to two different sheets.

Then click OK. The link is

automatically maintained for you in real time.