![]()

Trading Case CT1

Case Objective

To understand leverage and systemic risk in financial markets.

Key Concepts

Leverage; bank balance sheets; asset backed securities; systemic risk.

Case description

There are 3 banks, called IB (an investment bank), CB (a commercial bank), and RB (a retail bank).† Each of the banks has various assets and liabilities, as shown in the following table.

|

Assets |

Liabilities |

|

Asset Backed Securities (ABS) |

Deposits (except IB) |

|

Debt issued by the other banks |

Debt issued to other banks |

|

Other assets |

Other liabilities |

The investment bank does not have any deposits.† The ďotherĒ assets and liabilities are held fixed in the trading case.

The value of the ABS is external to the case, changes over time, and you will see its value on the trading screen (the price of the security names ABS), and it starts at 100 at the beginning of every trial.† At this initial value, every bank is solvent.†† If the ABS rises in value, then every bank is solvent at the end of the period, and is marked to market at the difference between its assets and liabilities.† If the ABS falls in value, then depending on how much a bank has borrowed, it may be insolvent.† If it is insolvent, then it may not be able to pay its debt, in which case the bank that holds its debt may in turn become insolvent.† Debt issued to other banks is subordinated to all other liabilities.† The exact composition of the balance sheets of the banks is not known to anyone.† However, over repeated trials, you may be able to infer the sensitivity of each bank to the value of ABS and the interconnectedness of their balance sheets.

Example

Here is an example, with numbers not related to the actual case parameters.† You should work through the example in a spreadsheet to get a feel for interactions of the balance sheets of the firms.

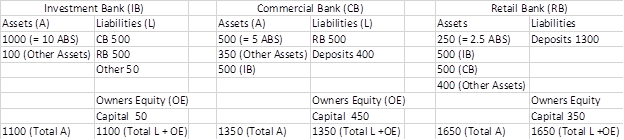

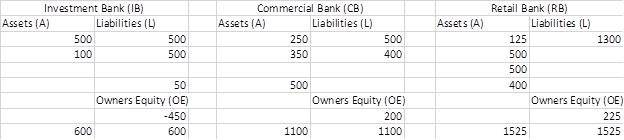

IB holds 10 units of the ABS, and has 100 in other assets.† It has issued debt with face value 500 to both CB and RB, and has other liabilities of 50.† Therefore, at the ABS value of 100, so it is solvent (assets=1100, liabilities=1050).

CB has 5 units of the ABS, external assets of 350, and the debt of IB as its assets.† It has issued 500 in debt to RB and has 400 in deposits.† So the initial value of its assets is 5*100+350+500 = 1350, the value of its liabilities is 900, and its mark-to-market value is 450 = 1350-900.

The above example is clearer when represented in T accounts each of which preserve the fundamental accounting equation Assets = Liabilities + Owners Equity.† The above initial conditions are as follows:

![]()

![]()

![]()

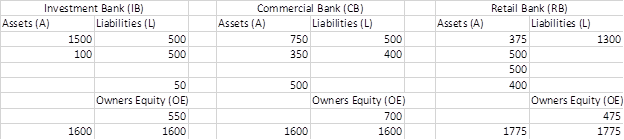

Scenario 1:† ABS increases in value to 150

If the ABS stays above 100, then IB remains solvent, as does CB.† For example, if ABS rises to 150, the IB will have assets of 1600 and liabilities of 1050, while CB will have assets of 1600 and liabilities of 900.† Again lets consider this in T account form as follows:

All bankís balance sheets are healthy and bank stock prices will appreciate.

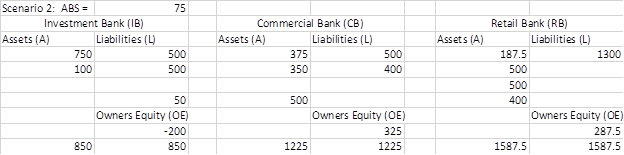

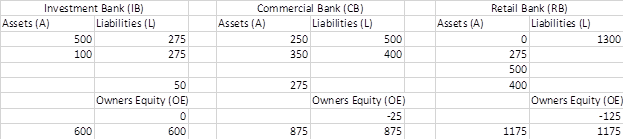

Scenario 2:† ABS falls in value to 75

If ABS falls to 75, IB will be insolvent (Assets = 850, liabilities = 1050).† The other liabilities are senior debt, so they have to be paid off first.† This leaves 800 of assets to pay back the other debt, which is allocated proportionately to all creditors, implying that CB is paid 400 and RB is paid 400.† Thus, CB incurs a loss of 100 on its debt holdings of IB.† This in turn reduces its asset value, so it ends up with assets=1125 and liabilities=900.

1st the impact of the drop in the price of ABS impacts IB by making it insolvent (Owners Equity = -200 below).†

Now consider what happens when IBís financial liabilities are revalued at market value which reduces their value to 400 for both CB and RB as illustrated below:

![]()

![]()

![]()

†

†

In the above at this price CB is still solvent and therefore RBís asset value from CB is unaffected and remains at 500, but observe that RB has taken a reduction in asset value from IB to 400.

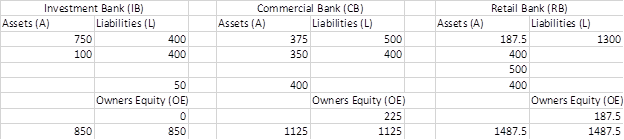

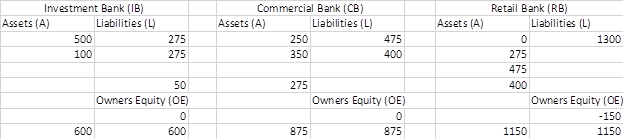

Scenario 3:† ABS falls in value to 50

If ABS falls to 50, IB will only have 600 in assets, and so will only be able to pay back 275 to CB and RB respectively.† This causes CBís assets to fall to 875 while its liabilities remain at 900.† Thus, the drop in ABS causes the failure of IB, which in turn causes the failure of CB.

Again the potential contagion example above can again be represented in T accounts as follows:

Now again consider what happens when IBís financial liabilities are revalued at market value which reduces their value to 275 for both CB and RB as illustrated below:

![]()

![]()

![]()

In the above at this price CB is now insolvent because their asset value from IB has fallen further to 275.† As a result, the value of CBís liability with RB now declines from 500 to 475 as illustrated below.

![]()

![]()

![]()

The above now reflects a full banking crisis where all banks are insolvent!

Trading

You trade for 1 period.† At the end of this period, your position is market to the realized value of ABS.† You can trade the three banks and a zero coupon bond with a face value of 100.† The risk free interest rate on cash is set to zero, and you can only borrow by selling the zero coupon bond.

Prices in this case are determined by the traders, so all trades will take place at bids and asks that either you or another trader in the system puts in.† During the trading day you can sell securities that you do not own.† This is referred to as short selling.† If you are short a security then any cash payment made to the owner of the security must be covered (i.e., paid) by you.† You can also borrow cash to purchase additional securities.†

Initial Position

Every trader starts with the same position in each bank.†

The Trading Objective

The object is to earn as much grade cash as possible by managing your position's exposure to changes in the value of ABS.†

Earning Grade Cash

In each market year securities are traded using market cash.† One market year is defined as one trial.† If, at the end of the trial, you have negative market cash, you will get -5 grade cash.† If you have market cash above 0, you will earn grade cash = market cash * 0.001.

Trading is conducted over a number of independent trials and a record of your cumulative grade cash is maintained.

Trading Objective

Your aim is to earn the maximum cumulative grade cash.