![]() Lesson: Payoff Diagrams and Option Trading Strategies

Lesson: Payoff Diagrams and Option Trading Strategies

Design

option trading strategies to take advantage of the following market views.

In each case, explain what is required for the strategy to break-even,

and analyze the tradeoff between the cost of the strategy and the potential

gain.

a)

The market is expected to move up significantly.

b)

The market is expected to be quite volatile and without a clear direction.

c)

The market is expected to trade within a narrow range.

d)

The market is expected to be volatile but with a downward bias.

e)

How can apply the above strategies to current market data?

From the

Virtual Classroom page click on the module Option Payoffs and run or open

directly from the web. The following screens will appear.

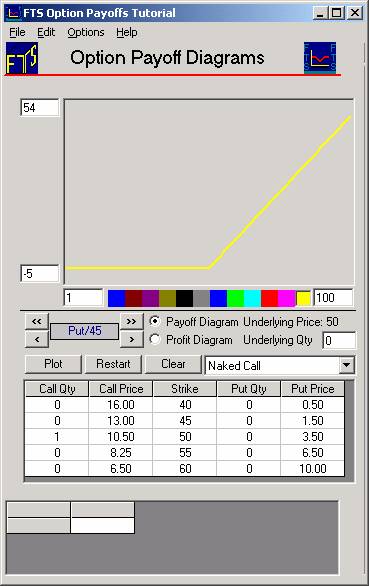

The top

window (which we call the Display Window) plots payoff diagrams for any strategy

you create. These strategies are

created in the bottom window, which we call the Action Window.

The program

starts with the default data set, which has five puts, five calls, an underlying

asset, and a futures contract on the underlying.

The options and the future mature in three months.

The purpose

of this module is to become familiar with the trading strategies.

You can enter your own data, so you can work with your own positions by

using the Option Portfolio Module. This

is covered in a later lesson. A

brief introduction to this is provided at the end of this lesson.

Working

with the default data set, you can see that the strike prices range from 40 to

60, shown in the column labeled Strike. Call

Qty and Put Qty are the quantities you hold (your position), and the Call Price

and Put Price are the market prices of the options.

Part a) of

the exercise asks for strategies that bet on a significant up movement in the

underlying asset. The simplest

strategy to take advantage of this view is to buy a call option, say the

45-strike call. The next figure

shows you how to use the Action Window.

First make

your selection from the drop down menu beside Naked Call (i.e., leave drop down

menu as is). To analyze the effects

of buying one 50-call, your Action Window should look like this:

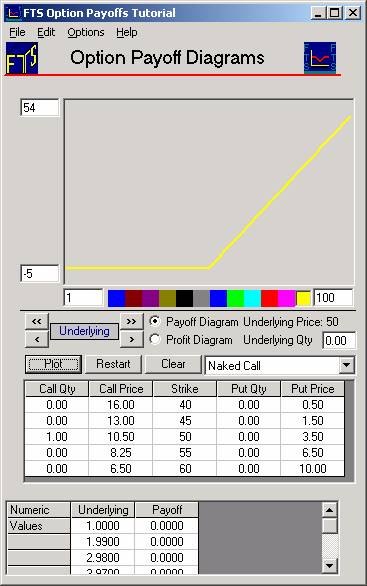

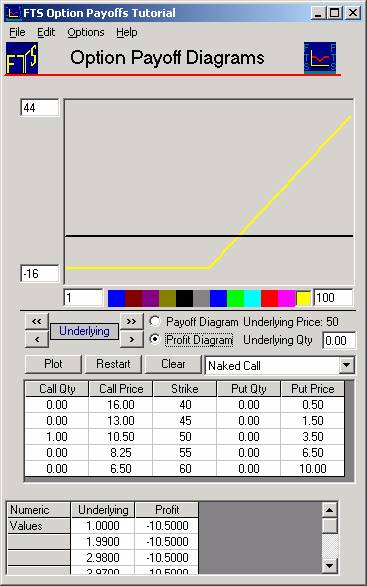

If you

select Profit Diagram the Display Window will show you the net payoffs from the

call (click the Refresh button if you have multiple lines on the screen):

Module

Notes:

To read off

the numbers associated with either a Payoff or a Profit Diagram see the grid

above. This displays the numerical

values associated with the current position you are working with.

You can

easily reverse the sign of any preset position by selecting the Option Menu,

Invert Position.

The

break-even analysis is as follows. If

the underlying asset would have to move up to between 60.4 and 61.4 to break

even (ignoring the time value of money). To

calculate the exact break-even point for the option, we need to solve for the S

so that:

S -50 = 10.5, so S = 60.5, where 50 is the strike price.

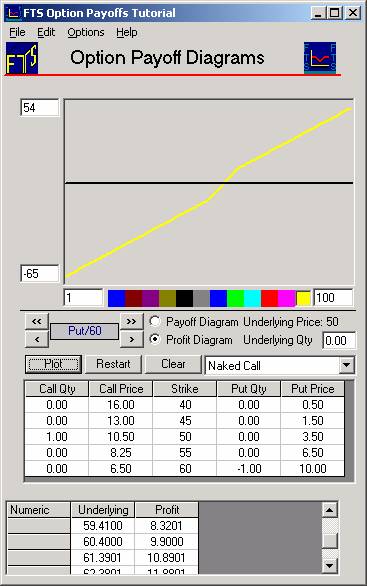

A more

leveraged position can be achieved by financing the call by selling puts.

For example, the 60-put costs $10. If

the market rises to break even and does not fall after the next 3 months, the

puts will be worthless. Therefore,

by selling three 50-puts, you can finance the call.

Selling the puts will net you 10.50, while the call costs 10.5.

To see the exposure you face, sell the puts to obtain the Action Window

shown next.

This

strategy costs nothing, but you can see that you face a far greater loss if the

stock value falls.

Note:

You should try different combinations of options, and analyze what movement in

the underlying asset is required to make them profitable.

Part b)

asks what you would do if you expected the market to be quite volatile but were

not willing to commit to whether it would rise or fall.

There are two well-known strategies that let you take advantage of such

beliefs. The first is a straddle

and the second is a (short) butterfly

spread.

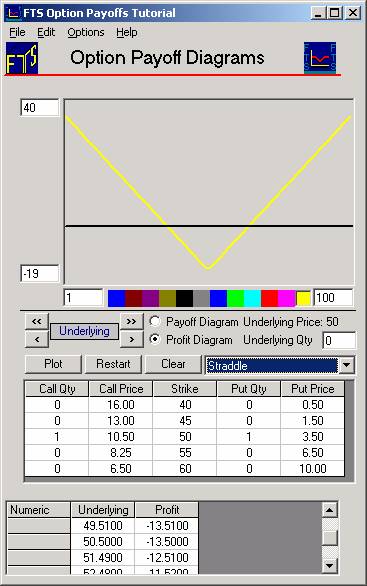

A straddle

requires buying a put and a call with the same strike price.

Since there are no clear beliefs about the direction of the market, you

would buy puts and calls which were at-the-money,

i.e., with strike prices as close to the underlying asset price as possible.

For our data set, this requires buying the 50 put and the 50 call,

leading to the following Display and Action Windows.

You can select this strategy again from the drop down:

The

strategy costs 14. To break-even,

the underlying asset must move either up or down.

If it moves up, only the call will be in the money, and the underlying

must move to a price S so that S - 50 = 10.5, which gives us S = 60.5.

If it moves down, only the put will be in the money, and we need that 50

- S = 5, so S = 46.5.

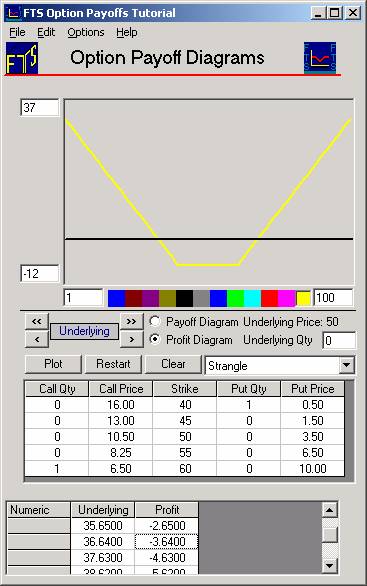

A cheaper

alternative is the strangle.

In this strategy, you buy a low-strike put and a high-strike call.

For example, buy a 40-put and a 60-call.

This leads to:

The cost

has dropped from 14 to 8 relative to the straddle.

To break-even when there is an up move, we require S - 60 = 6.5 which

implies S = 66.5. For a down move,

we require 40 - S = 0.5 so S = 39.5. In

comparison with the straddle, the moves required by the market are not that

different, but the cost of the strategy is a lot lower .

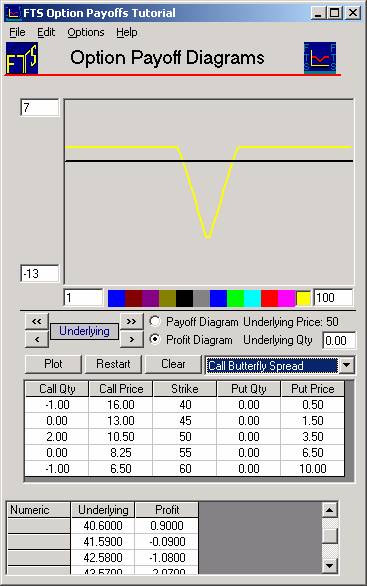

A (short)

butterfly spread is a similar strategy, except that it is constructed entirely

with puts or entirely with calls. For

example, select the call butterfly spread from the drop down menu and then click

on the Option menu. Invert Position to convert it into a short butterfly spread,

as follows:

You

actually get a payment of 1.50 for executing this strategy (the selling of the

65-put more than covers the cost of the 2 55-puts).

As you can see from the picture, you get a constant profit (of $5.50) if

the stock price moves a lot in either direction.

If it moves to 55.45, you lose $3.05 (+$1.50 from initial position +

$10.90 from the 50-call minus the $15.45 you got initially).

Check this from the profit payoff grid (see above).

Note:

You should construct a similar strategy using puts.

Part c) is

the opposite of Part b). Your

beliefs are that the market will trade in a narrow range.

Part b) already suggests some strategies: a short straddle or strangle or

a butterfly spread. We do not

present details of these here since they are easily re-produced using the steps

in Part b).

Note:

You can reverse positions by selecting the Option Menu and then Invert

Position sub menu item.

A trader at

Baring’s in

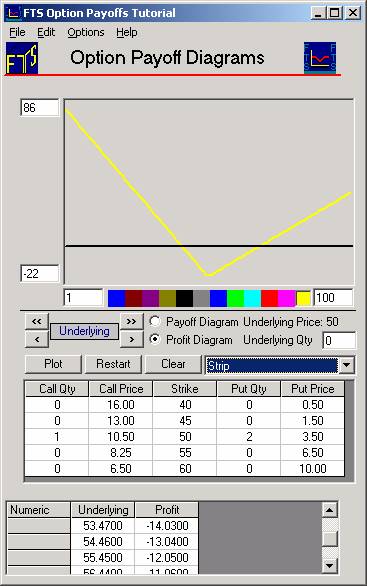

Part d)

adds a slight twist to Part b): there is now a directional bias in your view of the market.

The solution is clear: you buy more things that pay off when the

underlying asset falls (or sell more things that lose when the asset falls).

One

variation here would be to buy a straddle but to buy an additional put.

This combination is called a strip

and looks like (select the Strip strategy from the drop menu as depicted below):

(The

opposite of a strip is a strap, where

you buy 2 calls and one put.)

You could

also vary the (short) butterfly spread by buying a 50-put. The on-line textbook

describes several other strategies that are commonly employed.

e)

How do I work with my own options: Application

to Current IBM Options

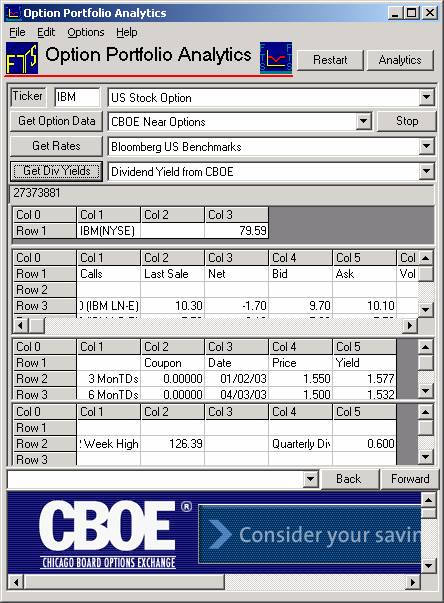

To define

your own options, launch the Option Portfolio Module from the Virtual Classroom:

Click the

three buttons above: Get Option

Data, Get Rates and Get Dividend Yields:

By

selecting CBOE Near Options you can get a liquid subset of options trading on

IBM (or whatever ticker you enter).

Side

Module Note:

You can read in your own dataset from Excel ---- to do so select from the

drop down beside the Get Option Data button Data from Excel.

A template is available for Excel from the Help menu in this module.

When downloading the template if you are prompted for a login and

password just hit Cancel and continue. This

is triggered on some systems and should be ignored.

This brings

up:

Click the

button Analytics to initialize the data.

Select

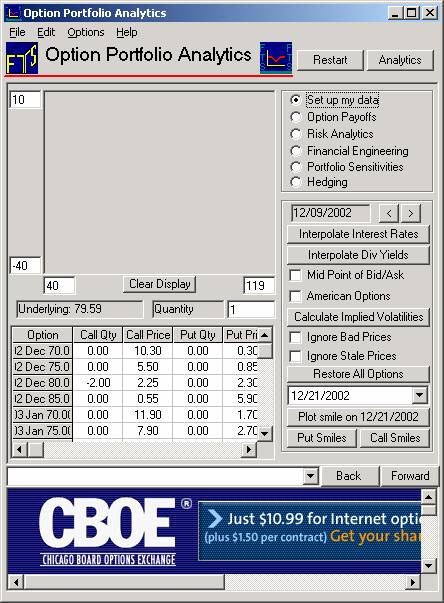

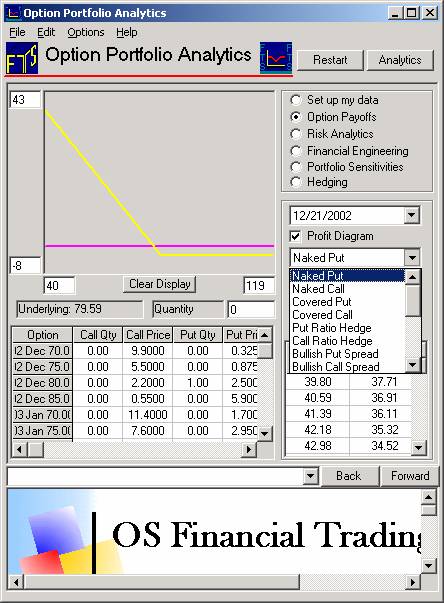

Option Payoffs as depicted below: From

the initial screen above select Option Payoffs.

The following screen will appear:

From the

above screen you can see that you have the same Option Trading Support when

using the drop down menu (depicted). The

difference is that now you are working with the current actual option prices.

©2003

OS Financial Trading System