Option

Calculator and Implied Volatilities

Using data

from the web or financial press, evaluate how well the option pricing models

explain stock option prices.

This

exercise is based on the Option Calculator Module on the Virtual Classroom.

The original numbers for this exercise were obtained closing stock option

data from the newspapers. The Option

Calculator allows you to automatically retrieve the latest data from the web.

But by working through this exercise you will learn how to apply the

calculator to the real world option markets.

Let

us use Intel as an example. On

|

Strike

Price |

Call

Price |

Put

Price |

|

55 |

9

1/4 |

7/8 |

|

60 |

5

1/2 |

1

¾ |

|

65 |

2

11/16 |

4

¼ |

|

70 |

1

1/8 |

7

¾ |

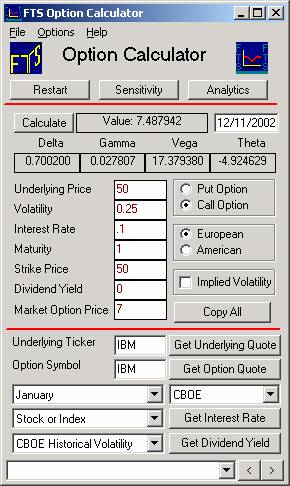

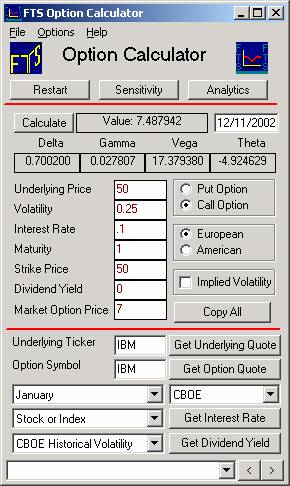

To

see how well the option pricing models explain this data, we need to know the

inputs required by the Option Calculator. Run

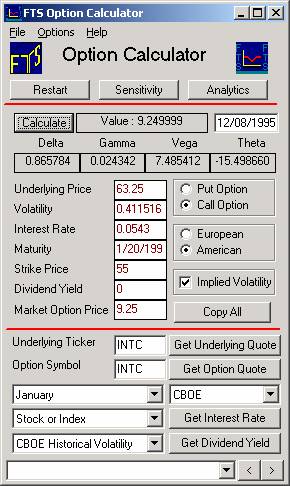

the Option Calculator directly from the Virtual Classroom page, to get:

Let

us start with the Black-Scholes model. To

apply it, we need to know the underlying asset price (which is 63 1/4), the

volatility, the risk-free interest rate, the time to maturity, and the strike

price. We do not need to worry about

the dividend yield; Intel will not be announcing or paying a dividend between

Dec 8 and the option maturity.

Lets

start with the maturity date. Stock

options in the

For

the case of this historical example we have a choice of two ways for entering

the time to maturity information. First

is to enter dates directly, and second is to use the FTS Calculator to compute

the annualized time to maturity. We

illustrate both ways next.

Maturity +

Choice of Entry Formats into the FTS Option Calculator

Current

time for example =

Date

of Maturity for the January option

You

can enter these two dates directly into the Option Calculator (

For

the case of the time to maturity

you can enter the number directly into the FTS Option Calculator (= 0.11780822).

Either form of entry (dates or number) is acceptable to the FTS Option

Calculator.

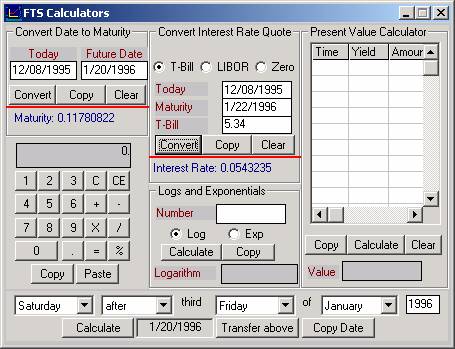

Interest Rate

The

Treasury Bill quote for the closest (1/22/1996)

maturity is 5.33.

The FTS Calculator (see screen below titled FTS Calculators) will convert

this to the continuously compounded rate:

Note:

For both of the above two entries you can use the FTS Calculator if you

want to. Launch from the Virtual

Classroom page and enter the appropriate information for settlement and T-bill

For

the option calculator we will use 0.0543 as our estimate for the risk free rate.

Spot Price of

Underlying Asset

Enter

63.25 in the Underlying Price field.

Strike Price

The

first strike price is 55, so enter that into the Strike Price field.

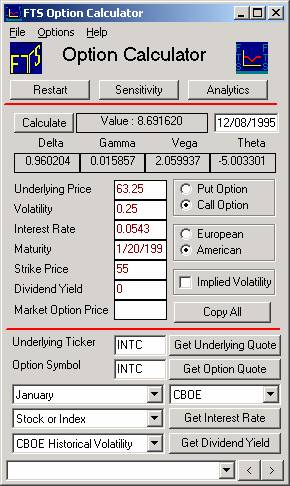

Finally,

set the style to American because regular stock options in the

Click

on calculate and your screen should now as follows:

The

above is the option price with the default volatility, 0.25 (or 25%).

We have not, however, taken any care to assess volatility when estimating

the price so far. So this raised the

important question when valuing options --- how do we estimate volatility?

This is important because trading options is exactly equivalent to

trading volatility and therefore much care must be taken when entering this

input.

The

Black-Scholes price above is 8.692 with volatility set at 25%.

The market price is 9 1/4. Since

price is an increasing function of volatility, we can interpret this as saying

that our estimate of volatility is too low for Intel.

There

are two ways in which we can obtain an estimate of volatility.

One is using historical data, which would require a data set on Intel

prices. The other is to calculate

“implied volatility,” i.e., the volatility implicit in the price of the

option.

What

should we put in for volatility? One answer is to calculate the volatility which

makes the Black-Scholes price equal to the market price.

To

calculate the volatility implied by the 55-call, click beside Implied Volatility

and type in the option’s price (9 1/4) in the new field that appears and click

OK. You should now see:

The

volatility implied by the option price is 41.2%.

Calculating

the Implied Volatility for Multiple Options

We

can calculate the implied volatilities of all the options.

Of course, if we calculate implied volatilities in this way, then the

model will fit the data perfectly.

So how do we tell whether the model provides an accurate description of

option prices? The answer comes from the fact the Black Scholes option pricing

model requires that the same

volatility work for all options.

We can easily test this out by calculating the implied volatilities of

all the options.

We simply have to change the strike prices and market prices, and then

calculate the implied volatilities for a set of options (see appendix to this

lesson for a note on how to automate this when working with your own position).

Consider

the basic set of data (let A/P denote American put option and A/C American call

option):

|

Option

Type |

Asset

Price |

Volatility |

Interest

Rate |

Maturity |

Strike

Price |

Dividend

Yield |

Market

Price |

|

|

A/P |

63.25 |

.4 |

.0543 |

.117808 |

55 |

0 |

7/8 |

|

|

A/P |

63.25 |

.4 |

.0543 |

.117808 |

60 |

0 |

1

3/4 |

|

|

A/P |

63.25 |

.4 |

.0543 |

.117808 |

65 |

0 |

4

1/4 |

|

|

A/P |

63.25 |

.4 |

.0543 |

.117808 |

70 |

0 |

7

3/4 |

|

|

A/C |

63.25 |

.4 |

.0543 |

.117808 |

55 |

0 |

9

1/4 |

|

|

A/C |

63.25 |

.4 |

.0543 |

.117808 |

60 |

0 |

5

1/2 |

|

|

A/C |

63.25 |

.4 |

.0543 |

.117808 |

65 |

0 |

2

11/16 |

|

|

A/C |

63.25 |

.4 |

.0543 |

.117808 |

70 |

0 |

1

1/8 |

|

It

is straightforward to change the strike price, option price and recalculate the

implied volatility for puts and calls respectively.

From this we can compute the implied volatilities as follows:

|

Option

Type |

Strike |

Implied

Volatility |

|

A/P |

55 |

0.4567 |

|

A/P |

60 |

0.3840 |

|

A/P |

65 |

0.3993 |

|

A/P |

70 |

0.4046 |

|

A/C |

55 |

0.4116 |

|

A/C |

60 |

0.4011 |

|

A/C |

65 |

0.3779 |

|

A/C |

70 |

0.3722 |

If

you plot the strike price versus the implied volatility for the put options, you

get:

Recall

that the stock price is 63.25, so the 65-put is closest to the money.

The graph shows evidence of the “volatility smile,” so-named because

of the shape of this curve.

For

the call, we get:

You

can see that this is less of a “smile” and more of a “smirk.”

The

results on implied volatility show that the option pricing model, which assumes

a constant volatility across strike prices and across puts and calls, does not

fit observed market data precisely.

There are several caveats that must be applied to this conclusion. First, we are not sure that we have the correct data. The stock price is taken at the close of the market, but we do not know when the options traded. Second, there is typically a bid-ask spread in the market, and the closing prices (of either the stock or the options) do not indicate whether the last trade took place at the bid or the ask. This makes a difference because the way the model calculates the value of the option is based on the prices at which the stocks and options can be traded. Third, we have not allowed for other factors such as transaction costs, which will also affect the model.

Using Current

Market Data:

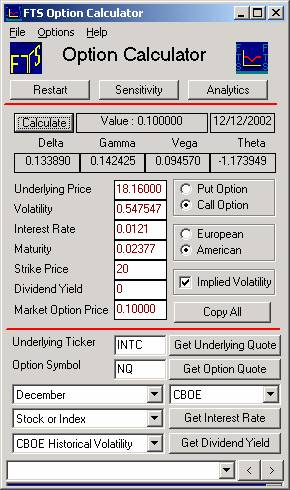

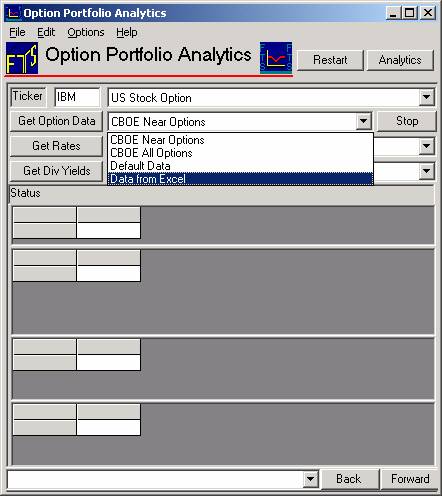

Once

you have worked through and understood the above historical example you can

apply the calculator to current examples. For Intel the stock symbol is

INTC and the option symbol is either NQ or INQ currently depending upon the

strike price.

See www.cboe.com Market Quotes (click

on Delayed Option Quotes as one way of getting to the symbol directory).

When

working with your own position involving multiple options, once you master using

the Option Calculator (the subject of this lesson), you can also use the Option

Portfolio Manager Module.

This module automates much of the tedious work associated with using

multiple option quotes.

This module automatically retrieves the latest (delayed) prices from the

web for options currently trading on the Chicago Board of Options Exchange (CBOE)

or you can link to Excel for other options. The

initial screen for the Option Portfolio Manager appears as follows:

You

will find that for Option Problems involving few options that the Option

Calculator is easier to use.

For problems involving a larger number of options and position

considerations then the Option Portfolio Module is preferred.