![]() Delta

Hedging in the Binomial Model

Delta

Hedging in the Binomial Model

In the 2-period binomial model, suppose you hold one put option.

Construct a trading strategy that lets you hedge the risk of this put

using the stock. At each node,

explain how the portfolio values are calculated.

To conduct this

exercise, run the Binomial Tree Module from the Virtual Classroom page.

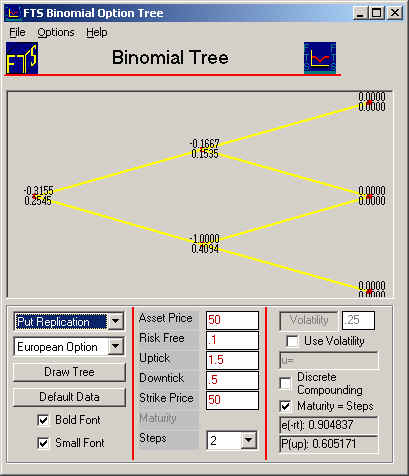

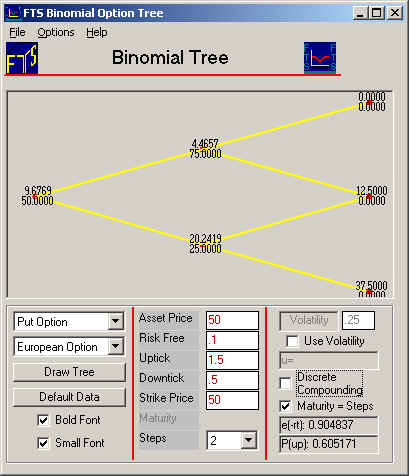

For the default data make sure “Put Option” is selected and set the number of periods to 2, select continuous compounding (i.e., leave Discrete Compounding unchecked) and check Maturity = Steps, so that you see the following screen:

The

above displays the values of the put option at each

node, which is the value of your assumed position. At

the initial node, the put is worth 9.68. The

put value after an up-tick is 4.47 and after a down-tick is 20.24.

Our objective is to

hedge the put option's price risk using the underlying stock.

First, we will define a number referred to as Delta, which is useful when

hedging option risk. Delta is

a number

that measures the change in the value of the option when the stock price

changes. Denote it by the Greek letter

![]() , so that

, so that

![]()

Therefore,

![]() DS = DP, or DP -

DS = DP, or DP -

![]() DS = 0, so if we hold -

DS = 0, so if we hold -

![]() stocks, then the change in the put

value will be mirrored by the change in the value of the -

stocks, then the change in the put

value will be mirrored by the change in the value of the -

![]() stocks.

stocks.

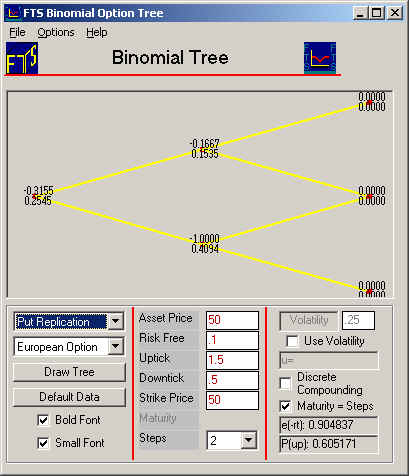

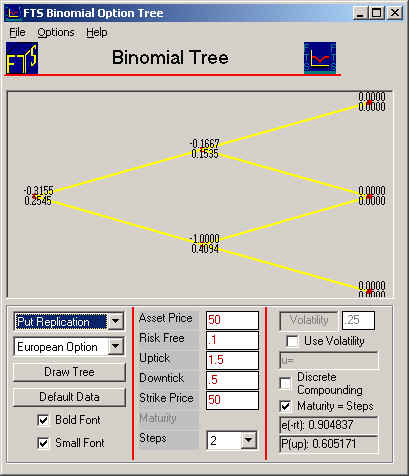

By selecting either the put or call replication from the drop down, the Binomial Tree Module will display the delta of the selected option at each node. For the current example put replication results in the following tree:

Creating a Riskless Position

At the initial node,

How do we do this?

The answer to is to replicate a short (i.e., -1 put option) position

To do this requires that we change the signs in a long synthetic put option position. That is, from a trading perspective we should borrow from risk free money market and buy 0.3155

stocks to replicate the short put option.

If we do this we can

create a position that is completely riskless. That is, we are long one

put option and simultaneously short one synthetic put option. The net

effect eliminates all underlying asset price risk from the

position. You can check, at the end of the first period, that your portfolio is worth $10.69 whether the stock ticks up or down. Let us calculate the

portfolio values to verify these numbers. In

these calculations, we will assume that you started with one put option and no

cash, so that if you buy stocks, you have to borrow money at the risk free

interest rate (which is 10% or 0.10). This

actually does not make any difference because you can assume you have some

initial amount of cash, and conduct similar calculations. Calculation at initial

node: You started with one put option worth $9.92, and bought 0.3155 stocks. The stock price at the initial node is 50, so you had to borrow 0.3155 x

50 = 15.775. Your portfolio value

is: Quantity Value Put

Option 1 9.68 Stock 0.31552 15.776 Cash -15.776 -15.776 Total 9.68 Suppose there is a down-tick in period 1: At this node, the stock price is 25 and the put is worth $20.24. Since the risk-free interest rate is 10%, you have to pay interest on the

money you borrowed, so the net position is: Quantity Value Put

Option 1 20.24 Stock 0.31552 7.888 Cash -15.776 -17.4352 Total 10.69 Quantity Value Put

Option 1 4.47 Stock 0.31552 23.664 Cash -15.776 -17.4352 Total 10.69 Now, the binomial tree

for put replication indicates that delta is -1: Since the delta is -1,

you need to hold one stock when you leave this node.

Since you have 0.31552 stocks, this means that you have to buy

(1-.31552)=0.68448 more stocks. The

stock price is 25, so you have to borrow an additional (0.68448*25)=17.112.

Let us see what happens when you do buy the additional stocks.

Note that your borrowings are now $34.5472 (= 17.4352 + 17.112). If there is a subsequent

down-tick (so there was a down-tick followed by a down-tick), you position will be: Quantity Value Put

Option 1 37.50 Stock 1 12.50 Cash -34.5472 -38.18 Total 11.82 Quantity Value Put

Option 1 12.50 Stock 1 37.50 Cash -34.5472 -38.18 Total 11.82 Now,

let us complete the calculation for the case where there was an initial up-tick. Calculation at node

after initial up-tick Now, the Binomial Tree

for put replication tells

you that the delta is -0.1667:

Since the delta is

-0.1667, you need to reduce your stock holdings.

You started with 0.3155, so you have to sell 0.1488 stocks. The stock

price is 75, so you get $11.1637 from selling the stock.

Your borrowings are therefore reduced to $6.2714, so in the next period,

you will repay 6.2714 x exp(0.1) = 6.931. Let

us see what happens. If there is a subsequent

down-tick (so there was an up-tick followed by a down-tick): Quantity Value Put

Option 1 12.50 Stock 0.1667 6.25125 Cash -6.2714 -6.931 Total 11.82 If there is a subsequent

up-tick (so there was an up-tick followed by an up-tick): Quantity Value Put

Option 1 0 Stock 0.1667 18.75125 Cash -6.2714 -6.931 Total 11.82 (C) Copyright 2003, OS Financial Trading System![]() is -0.3155.

This means that to replicate a long (i.e., +1) put option we should sell 0.3155 stocks and lend the proceeds to the money market.

But recall our goal is to create a riskless position when we already own one put option.

is -0.3155.

This means that to replicate a long (i.e., +1) put option we should sell 0.3155 stocks and lend the proceeds to the money market.

But recall our goal is to create a riskless position when we already own one put option.